Customers are using new ways to pay for goods and services and increasingly they’re wishing to do so with companies in the motor trade.

Digital payments are revolutionising not just the speed of paying for products and services, but also changing the relationship between customers and businesses.

Car buyers have embraced new forms of paying for their cars in recent years, but when it comes to paying for often costly maintenance and repair work, many customers struggle to make the sums add up.

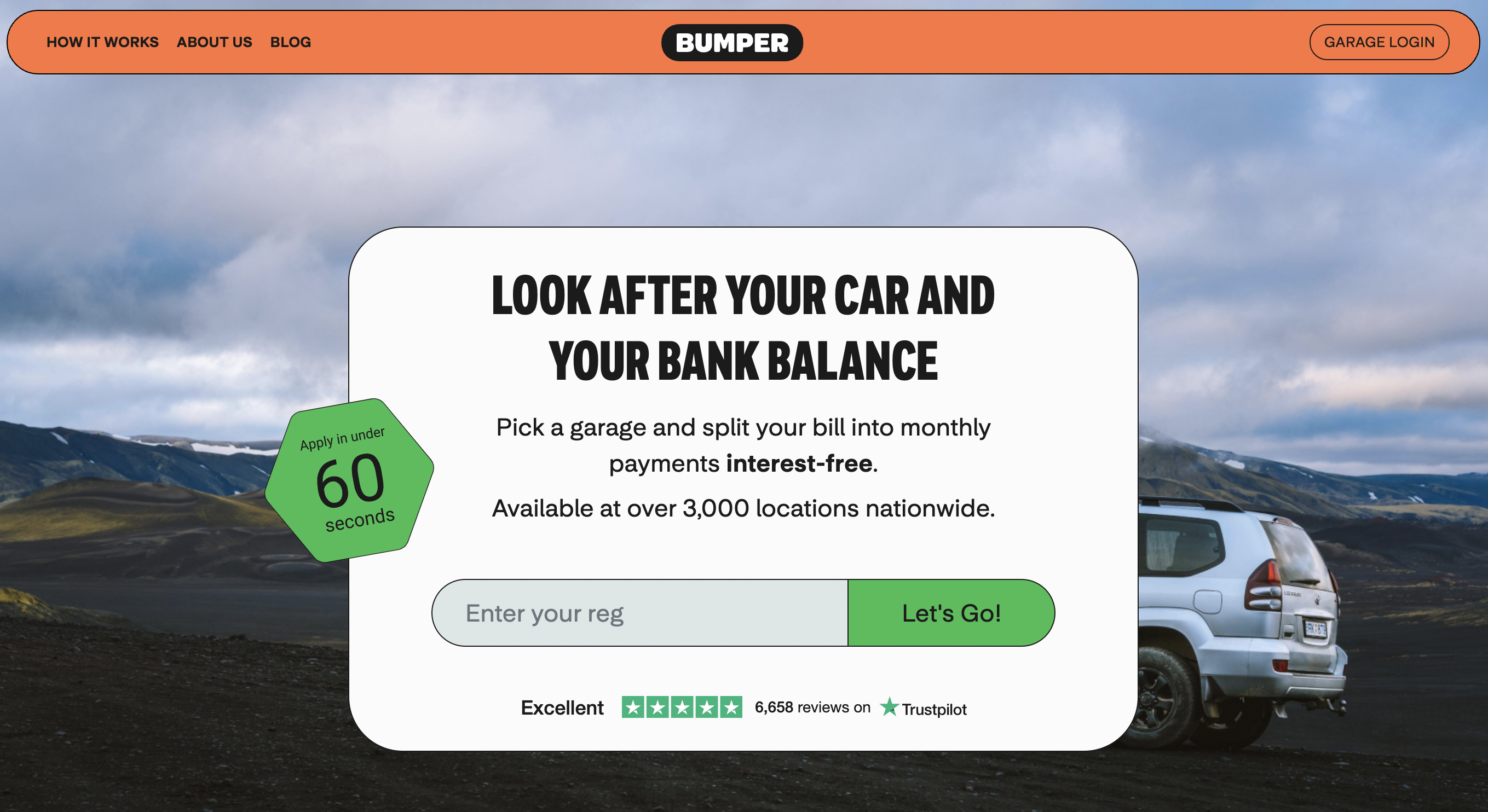

This is where Bumper can help. Previously known as Auto Service Finance, Bumper is a specialist in splitting those often costly bills into interest free payments.

More than that, Bumper is also at the forefront of recognising the changing ways customers are paying for goods and services, and works with a larger number of dealer groups in the UK and the Republic of Ireland.

Speaking on Car Dealer Live, Bumper co-founder Jack Allman explained the reasoning behind the business and why it’s helping dealers and customers.

He said the firm recognised a ‘chasm’ between customers wanting to get maintenance work carried out on their cars and being able to afford to pay the bills.

‘We recognise in reality everyone wants to drive a safe car, but there’s a reason that they’re not getting work done,’ he said.

‘For some people that might be convenience, but for lots it relates to affordability and to price. From our point of view, we wanted to step in and provide a way to bride that gap.’

But how can Bumper help dealers and garages? Simply, it can help smooth out the often fragmented nature of reporting issues to customers, then getting their approval to carry out the work and then paying for the work.

‘We took on a huge undertaking to knit a lot of that together, and ultimately present the dealer and the customer with something that connects that final point from a digital journey,’ Allman explained.

‘Let’s take a traditional example: someone will have a vehicle health check done, they’ll have had the work priced up, a video will have been recorded and sent to that customer. What we do is integrate our payment options into that delivered video or vehicle health check.

‘The customer, at the point of reviewing their video, can review the work that’s required, and then can approve and authorise that online. The key thing is that they can actually pay for that work, but equally, they then have choice of payment as well.’

Allman explained how Bumper can offer customers a variety of options from a single payment, splitting payments interest free or choose a ‘buy now pay later’ option. Customers can also use Apple Pay and Google Pay if they prefer a faster, more digital form of payment.

It’s not just maintenance work, though, as Allman explained how many large dealer groups who work with the firm are asking Bumper to offer its joined-up payment methods on a variety of different products – accessories for example.

Ultimately, Bumper allows dealers to offer payment methods which are in-line with customers’ purchasing habits – something which has massively pivoted towards digital payment methods in the past 12 months because of the Covid-19 pandemic.

In the video, Allman also explains:

- Why digital payments have grown in popularity

- Why customers have changed their buying habits – PCPs and service plans, for example

- Why dealers need to be integrating different forms of payment into their businesses

For more information, visit bumper.co.uk