The UK new car market enjoyed a third month of growth in October, with registrations rising by 26.4 per cent to 134,344 units, according to figures released this morning by the SMMT.

Fulfilment of strong order books helped deliver the bounce-back, it said, but in the year to date, the market is down 5.6 per cent on the same period in 2021, when deliveries fell by 24.6 per cent, and still a third below pre-Covid levels.

Last month’s growth was mainly driven by large fleet registrations, which grew by 47.4 per cent to 67,911 units, while those by private buyers rose by 7.4 per cent to 62,714. Smaller businesses recorded a 108.6 per cent increase, although at 3,719 units this is a small segment of the market.

Zero-emission-capable car deliveries continued to grow in volume, with battery-electric vehicle (BEV) registrations increasing by 23.4 per cent to 19,933 and plug-in hybrids (PHEVs) by 6.2 per cent to 8,899.

However, BEV uptake grew by less than the overall market for the first time since the pandemic, meaning October was the first month to see BEV market share fall year on year since May 2021, mainly because of supply challenges.

Deliveries of hybrid-electric vehicles (HEVs), meanwhile, rocketed by 81.7 per cent to account for more than one in 10 new cars, as supply was prioritised for a raft of popular new models.

Overall, electrified vehicles accounted for one in three registrations, while more than a fifth (21.5 per cent) came with a plug.

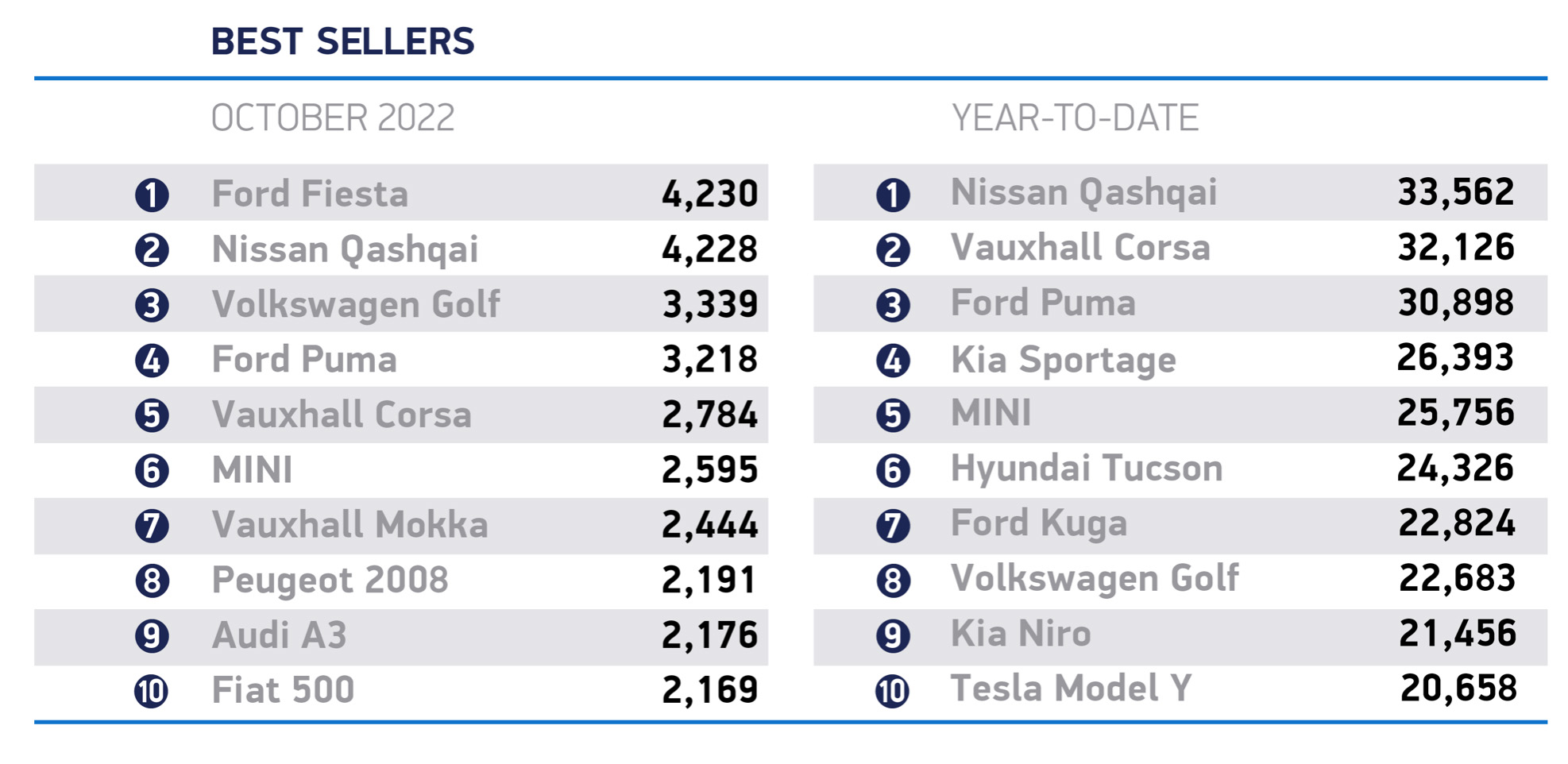

The top-selling car was the Ford Fiesta – shortly to be axed – with 4,230 registrations. It was closely followed by the Nissan Qashqai at 4,228.

Ongoing supply chain shortages, surging inflation and a growing cost-of-living crisis have led the SMMT to revise its market outlook for the year downward by 2.2 per cent, with 1.566 million registrations now expected.

It puts 2022 on course to be the market’s toughest year since 1982.

More positively, however, demand for EVs is expected to result in a plug-in market share of 21.9 per cent. Overall market recovery is anticipated to continue through 2023, with an outlook of 1.808 million units and plug-ins accounting for 26.7 per cent of registrations next year.

The SMMT said that such growth underlined the importance of increasing public chargepoint availability.

At the start of October 2022, the UK had 34,637 public standard, rapid and ultra-rapid electric vehicle charging devices, with 1,239 new rapid chargers and 5,023 new standard chargers installed during the first nine months of the year.

With 249,575 new plug-in registrations during the same period, just one new standard public charger has been installed for every 50 new plug-in EV registrations.

At this rate, said the SMMT, it is unlikely that the government’s ambition for 300,000 public chargers by 2030 will be met.

Chief executive Mike Hawes said: ‘A strong October is hugely welcome, albeit in comparison with a weak 2021, but it is still not enough to offset the damage done by the pandemic and subsequent supply shortages.

‘Next year’s outlook shows recovery is possible and EV growth looks set to continue, but to achieve our shared net zero goals, that growth must accelerate and consumers given every reason to invest.

‘This means giving them the economic stability and confidence to make the switch, safe in the knowledge they will be able to charge – and charge affordably – when needed.

‘The models are there, with more still to come; so must the public chargepoints.’

The SMMT said that with stretched infrastructure and the cost-of-living crisis both having the potential to undermine future uptake, the government’s Autumn Statement, set for November 17, provided an opportunity to stimulate demand and deliver economic growth and net zero progress.

Further measures to mitigate energy costs in the longer term for consumers and businesses would give greater confidence, it added, warning that now was not the time to raise motorists’ costs, which would likely stoke inflation and damage broader government revenues from new car sales.

It called for a long-term fiscal commitment to zero-emission motoring, which it said would go a long way to stimulating investment and demand.

Reducing VAT on public charging to bring it into line with home charging would level the playing field for drivers unable to install a home chargepoint, it said.

What the industry says

It’s getting harder for some to switch to EVs

The new car market remains below pre-pandemic levels, and the latest interest rate hikes will eventually lead to costlier finance plans for new car buyers.

The economic climate is moving away from the direction the industry needs it to, and this is becoming increasingly problematic for manufacturers that are having to invest in new electric vehicle plants and grow their electric vehicle line-up to meet government-imposed targets.

Though electric vehicle sales continue to grow, rising energy prices and the cost of living is making it harder for some to make the switch.

Jim Holder, editorial director, What Car?

A welcome ray of winter sunshine

New car sales usually fall as we head into the winter months, with people prioritising Christmas over car purchases. Therefore, it is a welcome ray of winter sunshine to see such an uplift in new car sales versus last year.

Even more encouraging is that EV sales are a significant factor as more drivers turn electric ahead of the 2030 fossil fuel ban on new car sales.

Alex Buttle, co-founder, Motorway

Greater challenge comes from cooling demand

While supply issues have held back new car sales for much of 2022, the greater challenge for the industry now comes from cooling demand.

With the Bank of England again raising interest rates yesterday, the cost of car finance is increasing just as consumers see their disposable income squeezed by double-digit inflation.

The net effect is to make many people reconsider their attitude to big-ticket purchases. That’s why many drivers are opting to buy their next car second-hand rather than new.

James Fairclough, CEO, AA Cars

A tough landscape to naviagte

Although there have been recent signs of recovery, supply constraints and cost pressures continue to cause headaches and make it a tough landscape to navigate.

Though October has been a positive month, demand is likely to soften as a result of the cost-of-living crisis and people tightening their budgets to protect their finances.

With the UK facing the longest recession since records began, it would not be surprising to see prospective buyers put off their purchases.

For the time being, emphasis remains on dealers to utilise all the tools and insight available to them to best cater for demand in the face of limited supply.

Lisa Watson, director of sales, Close Brothers Motor Finance

Action needed soon to meet net-zero ambitions

If we are to inspire confidence in people to make the switch and alleviate charging anxiety, we need to make sure people can rely on the public charging network. This means increasing numbers, improving reliability and making sure that pricing is fair.

Last month we learnt that there are more charging points in Westminster than Birmingham, Liverpool and Manchester combined. This is shocking, particularly when we know that little progress has been made when it comes to the government reaching its target of 300,000 public charging points by 2030.

‘With Cop27 just around the corner, if those in charge are serious about the UK’s net-zero ambitions, action needs to be taken – and soon.”

Ginny Buckley, founder and CEO, Electrifying.com

Comsumers clearly lapping up what’s available

Last month’s registration figures are better than expected amidst the current economic churn as the fulfilment of previous order books and continued demand for new vehicles boosted car dealers in October.

Although UK production figures have fallen in recent months, consumers are clearly lapping up what is available.

‘The continuing strength of demand for new cars will be a significant unknown for the UK motor industry in the months ahead, but whatever happens, dealers will be focused on making sure that any consumer appetite is suitably fed.’

Karen Johnson, head of retail & wholesale, Barclays Corporate Banking