Supercars are designed to be driven – but if you’re looking for one that might also rise in value there are some to hunt down.

Luxury car pricing experts Brego – a firm that uses machine learning and algorithms to predict the future values of luxury cars for finance houses – has identified 10 supercars that are a safe bet to place your cash.

Three Ferraris feature in the top 10 which will please Maranello – especially after the 812 Superfast was named as one of the biggest depreciating luxury cars of 2020.

Supercar prices have mostly fallen during the pandemic, but car dealers are starting to report that they are starting to see them strengthen again.

Luxury car dealer Tom Hartley told Car Dealer that after a period of falling prices, the market is beginning to strengthen.

Simon Hunt, CEO of Brego, compiled this list exclusively for Car Dealer and says his firm analyses billions of data points to ‘accurately predict values up to five years in the future’.

He said: ‘Nearly all cars lose value over time but in a few rare cases some can be a good investment.

‘These cars usually go on to be classics, like the Aston Martin DB5, and are much sought after by collectors.

‘The last year has been a rough time for supercar owners, but Brego has used their vast dataset to find the top 10 cars we think are likely to be a great investment over the next three years.

Hunt says the firm has data for 500,000 unique models but only a ‘small fraction’ are expected to rise in value in the coming years.

He added: ‘The supply of available cars is usually a big factor – either through low production or as cars age.

‘Other factors that tend to increase the value are cars that were undervalued at release or had very positive reviews.

‘Design is also a big factor too, some cars still look fantastic even after 20 or 30 years and this increases the desirability and the price.’

Here’s what Brego predicts will happen to supercar prices in the next three years:

10. 2007 Ferrari F430 F1

The F430 replaced the Ferrari 360 to improve aerodynamic efficiency and add some signature styling from the Enzo and Testarossa. It was met with positive feedback and because of its relatively low production count, the F430 F1 has begun to see some increase in prices. The amount of increase will heavily depend on the condition and specifications of each car, but we’d expect to see a minimum of £3,000 increase for a good example.

9. 2005 Ferrari 612 Scaglietti F1

The Ferrari 612 Scaglietti F1 was introduced in 2004 and prices steadily depreciated until roughly 2012. Since then the value of the 612 has fluctuated but has started to rise in the last few years. It’s due to increase by around £5,000, but this will heavily depend on the overall quality/ maintenance of the car.

8. 2007 Aston Martin Vanquish S

Modern Aston Martins usually depreciate with the exception of a handful of models. The Vanquish first lost tens of thousands of pounds before levelling out at its current value. However, with demand now rising for this future classic and with after-market improvements (Callum Design) on the horizon, the 2007 Vanquish S is now back on track for a future investment car.

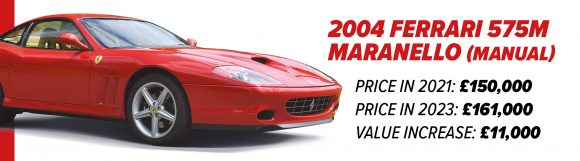

7. 2004 Ferrari 575m Maranello (Manual)

The 575m Maranello was designed by Lorenzo Ramaciotti at Pininfarina. Some 2,056 examples were made with 246 being produced with manual transmission. The small production number of manual 575M Maranello’s have caused the Ferrari to begin to appreciate in value and we would expect it to gain just over £10,000 in the next three years.

6. 2011 Porsche Speedster Special 997 PDK

The Porsche Speedster Special was a limited run 911 soft top. Only 356 were made and reviews were extremely positive. The sheer rarity of these cars made the price spike in the first few years and now it continues to rise at a steady rate. Porsche 911’s often hold their value and the special editions are well worth investing in if you want little to no depreciation.

5. 2017 Morgan Aero Supersports V8 Targa

While not a supercar, the Morgan has everything you look for in an appreciating sports car. A V8 developed by BMW which produces 360bhp can launch the car to 60mph in under five seconds.

Morgan typically maintain their value very well due to the low production numbers and a very specific market. But their flagship Aero Supersports is on target to gain £14,000 in the next three years.

4. 2002 Lamborghini Murciélago VT Coupe

The Murciélago replaced the Diablo as Lamborghini’s flagship model and the VT model was the original. The overall appearance of the car may have something to do with the increase in valuation and popular demand has allowed the Lamborghini to hold its value to the point where we now see a potential rise of £25,000 in the next few years.

3. 2016 Porsche 911 R

High-end Porsches hold their value very well. As one of the newest cars on this list, it’s impressive that it’s managed to gain so much value since new (base models started at around £140,000). As production was limited to 991 units, the R was sold out in the UK and because of the relatively low production count and high regard this car holds, the R quickly doubled in value. By 2023, we expect it to have increased by at least £25,000 for a car in great condition.

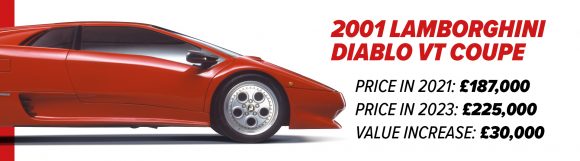

2. 2001 Lamborghini Diablo VT Coupe

The Lamborghini Diablo ran from 1990 to 2001 with the VT edition being produced from 1991. Lamborghini typically hold values quite well, with the modern Aventador depreciating less than most rivals. While the reviews of the Diablo said it was difficult to drive, the overall aesthetic might have something to do with the demand of this Lamborghini, just as we’ve seen with the Murciélago.

1. 1988 Aston Martin V8 GT

While definitely more of a classic, the 1988 V8 Vantage is the highest appreciating cars on our list. While classic Aston Martins are no stranger to heavy appreciation (the DB5 is a great example), Aston Martin built less than 1,000 of each series of Vantage prior to the 2006 re-launch. We expect it to pile on around £38,000 in three years.