The best possible price is the most important factor for people when it comes to deciding where to buy their next vehicle.

That’s according to a major study into what’s driving car-buying in 2022 that’s just been published by international research, data and analytics group YouGov.

The survey, carried out in July, uncovered how car purchase behaviour and channels are evolving.

One headline figure is that 15 per cent of global respondents said they would buy from an online retailer such as Cazoo – but the figure was even higher among Brits at 18 per cent.

The global auto white paper – The Road Ahead For Future Car Buying – covers 18 global markets, and had more than 19,000 respondents, with the results further bolstered by research from syndicated surveys YouGov Global Profiles and BrandIndex.

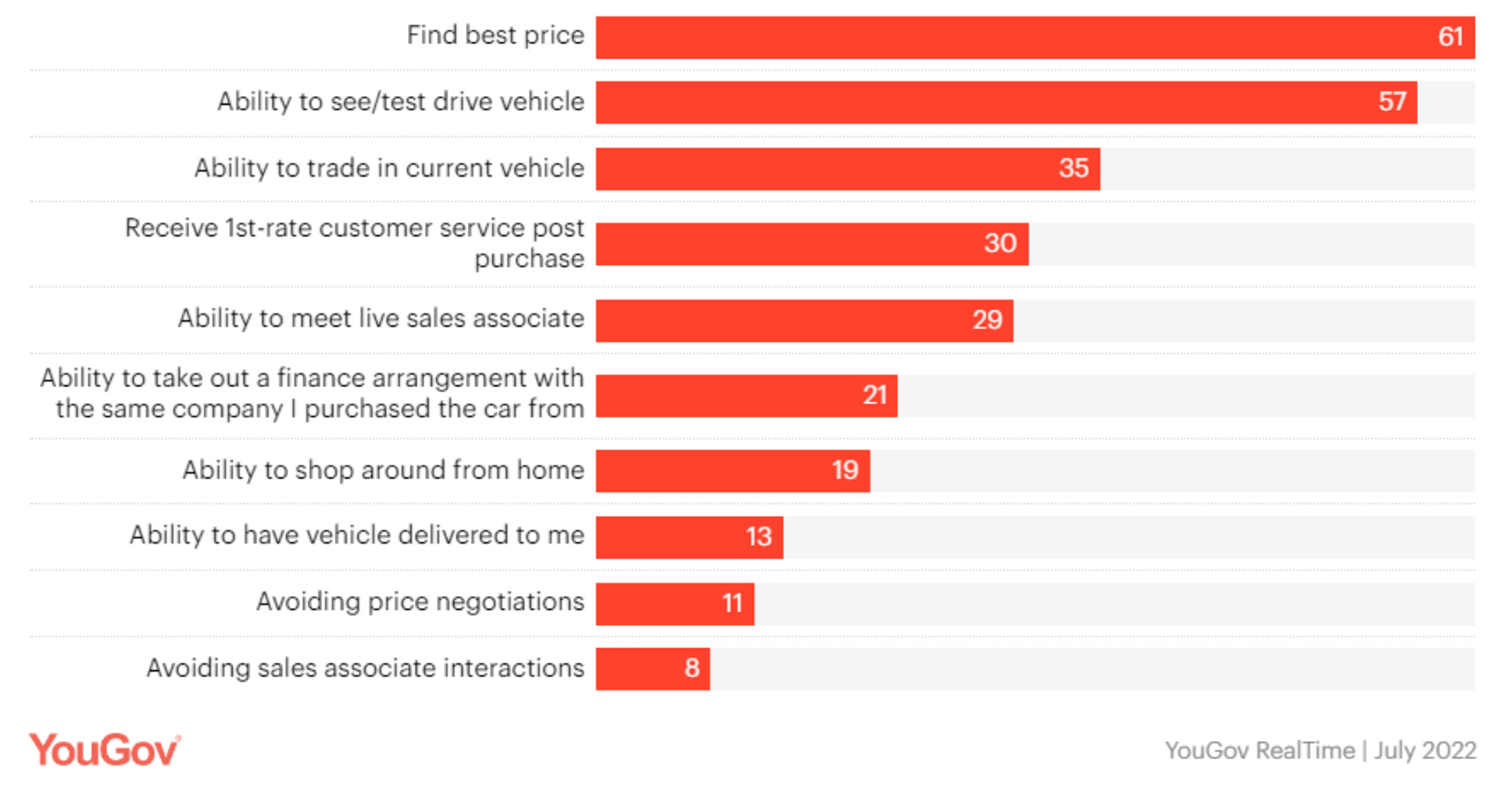

YouGov said that against the backdrop of rising inflation affecting many parts of the world, it came as no surprise that price ranked highest.

It was especially apparent among future car buyers in Great Britain, where nearly two-thirds (65 per cent) of the 2,004 sample size were focused most on price.

The report also looked at the drivers to car purchase as well as the interest and appetite for electrification in the luxury and premium global auto market.

Being able to experience how a vehicle drives in-person was the second most influential factor, with more than half (57 per cent) of future car buyers saying they would test-drive before buying.

More than a third (35 per cent) of global car buyers also considered the ability to trade in their current vehicle as an important factor when it came to where they would buy their next vehicle.

But almost a tenth – eight per cent – wanted to avoid interacting with a real-life person when buying a car.

The most important factors to global car buyers when deciding where to buy a new vehicle. (Figures are percentages.)

Other findings included the fact that 68 per cent of global consumers would still consider buying in-person at a dealership (82 per cent in Great Britain), 15 per cent would buy from an online car retailer such as Cazoo (18 per cent in Great Britain), and 13 per cent from a manufacturer that only sells cars online, such as Tesla or Polestar (also 13 per cent in Great Britain).

Almost two thirds (65 per cent) of global consumers agreed that the future vehicle industry is electrification (65 per cent in Great Britain), with just 11 per cent disagreeing, although for Great Britain that figure was nearly a fifth at 19 per cent.

As far as buying a luxury/premium electric vehicle is concerned, 59 per cent were interested globally (50 per cent in Great Britain).

As well as Great Britain, the markets surveyed were the US, Canada, Mexico, France, Germany, Spain, Denmark, Italy, Poland, Sweden, Australia, China, Hong Kong, Indonesia, India, Singapore and the UAE.

The white paper can be downloaded in full from here.