Dealerships need to put customers first when building their future omnichannel strategy.

That’s according to Cox Automotive after recent findings by automotive research and consulting organisation ICDP.

In its latest edition of AutoFocus, Cox Automotive says it’s important to combine online and offline touchpoints for an outstanding customer experience and to develop loyalty.

Insight and strategy director Philip Nothard says: ‘For anyone working in the downstream end of the motor industry, it is clear we’re going through a period of massive change.

‘This has left many retailers confused and wondering how to prioritise their resources.

‘With the emergence of countless new approaches, concepts and tools, it is easy to forget that these techniques are just fragments of the overall picture that is modern retailing.

‘Our aim should always be to support customers, and we must evolve in line with their needs.’

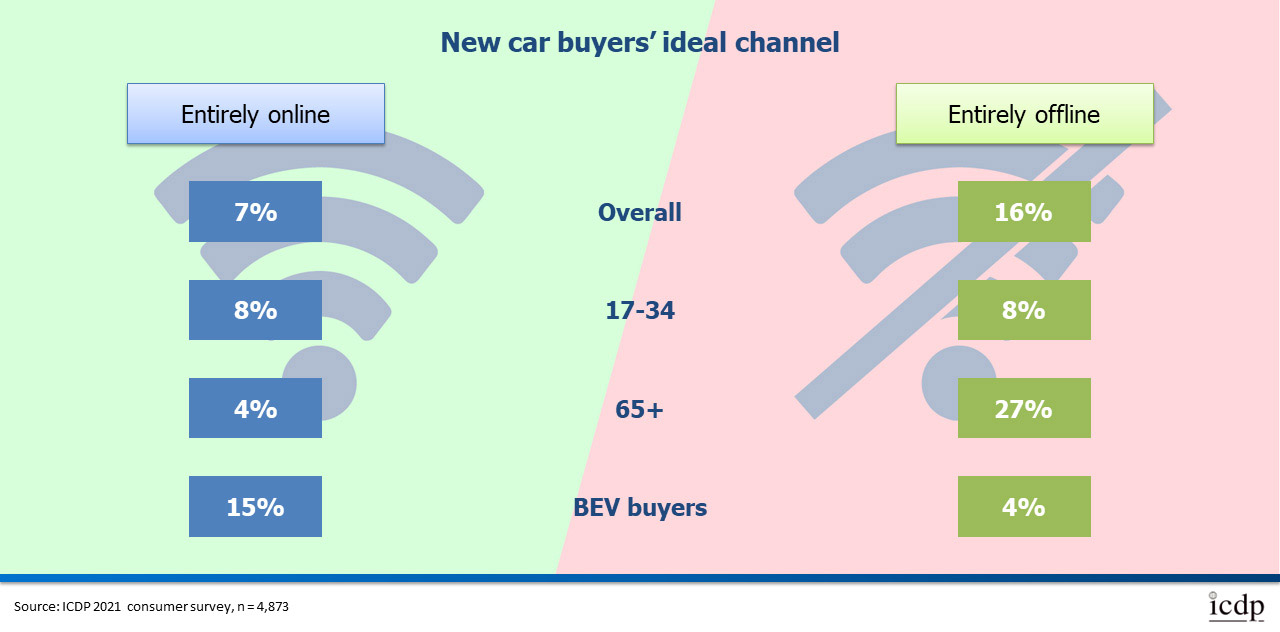

ICDP managing director Steve Young says in AutoFocus: ‘We found that 80 per cent of customers want to use both online and face-to-face channels during their new car-buying journey, rather than solely one or the other.

‘There needs to be more focus on how the two work together in an omnichannel sales approach to offer customers a seamless buying experience.’

Cox Automotive emphasises the need for a unified sales process underpinned by IT infrastructure that’s accessible to manufacturers, retailers, and customers.

It says technology can unlock the potential of customer data to create a more efficient retail environment – but progress in creating such an integrated system has been slow.

Young added: ‘Customers have repeatedly highlighted that it is people who can make their customer experience great.

‘ICDP research dating back to 2008, when the digital age truly began, has consistently shown that the most influential factor on a car-buying journey is the quality of the people at the dealership and the interactions those customers have with them.’

And although online channels are becoming increasingly important, customers still value having physical access to cars, while being able to test-drive is also an influential factor in decisions to buy.

Cox says this has become increasingly challenging because of the number of models and variants within most manufacturers’ ranges, so it is impossible to have a truly representative selection on display and to test drive.

This highlights another challenge when it comes to operational and inventory costs for retailers to store more vehicles.

However, this can be addressed via manufacturer planning and ownership of display and demonstrator cars, only having some models at regional hubs, using physically larger colour and trim samples, and digital tools, including virtual reality, says Cox.

Nothard said: ‘If, as an industry, we can create a unified retail platform, attract good-quality people, and generate an appropriate mix of display and demonstrator cars, then we have the foundations for fully meeting retail customer expectations.

‘Moreover, anyone who achieves this will have the building blocks that allow them to differentiate themselves from competitors who keep trying to apply point solutions to a model that needs more fundamental reform.’