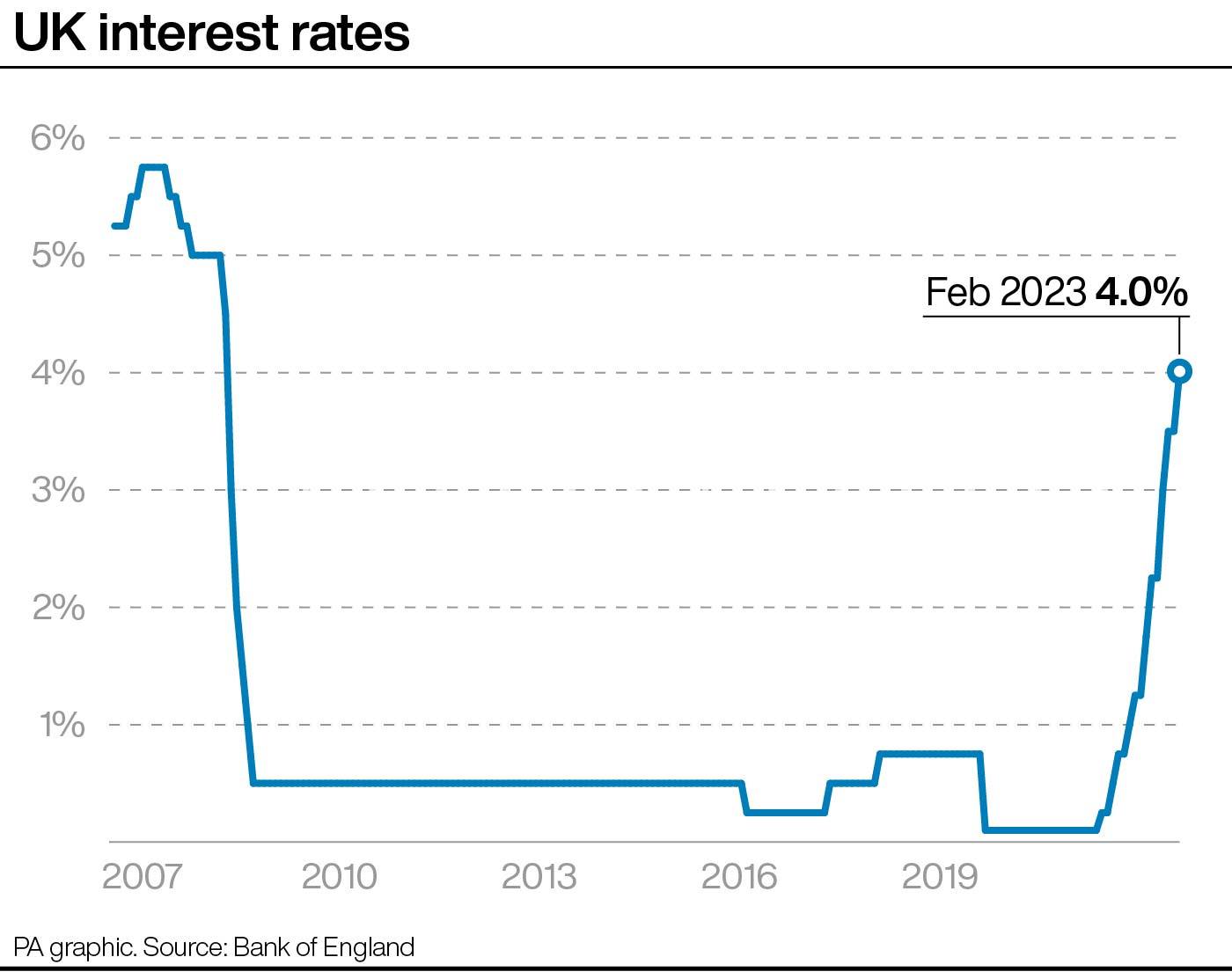

Interest rates were raised to four per cent today – the tenth month in a row that the Bank of England has hiked them.

The decision by the monetary policy committee (MPC) is aimed at bringing down the country’s double-digit inflation but will heap further pressure on mortgage borrowers.

Seven members of the Bank’s nine-person MPC voted for the 0.5 percentage point rate hike, while the other two voted to keep the base rate at 3.5 per cent.

And the MPC warned: ‘If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required.’

The Bank also said the UK was still heading for a recession, but emphasised that the downturn could be shallower and shorter than previously expected.

Gross domestic product (GDP) is set to shrink to one per cent from around three per cent.

The Bank said that was because wholesale energy prices had fallen significantly since the MPC made its last forecast, in November, and inflation had begun to fall from its peak last year.

The UK is poised to suffer a recession of five consecutive quarters, beginning during the first three months of this year. But the Bank said the decline will be much softer than in previous recessions, such as during the 2008 financial crisis.

GDP is expected to fall by 0.5 per cent over 2023 and by 0.25 per cent next year, before picking up to almost one per cent by 2025.

The rate of unemployment is expected to peak at 5.25 per cent – lower than the 6.5 per cent that was previously forecast.

Markets expect interest rates to reach 4.5 per cent towards the end of this year – significantly lower than the 5.25 per cent peak forecast when the MPC met in the wake of the mini-Budget.

Rates will then stay above 3.25 per cent for at least the next three years, according to the forecast.

The Bank said average household energy bills will likely drop below £3,000 – the level of the government’s price guarantee – from the start of July.

But it still believes that gas prices will stay high for years to come. In 2025, gas prices will be around 136p per therm, versus 52p on average between 2010 and 2019.

Car Dealer Live – the future of the car dealer – exclusive conference features talks from leading car dealers, Google and Auto Trader among much more. Find out the full event details and book tickets.