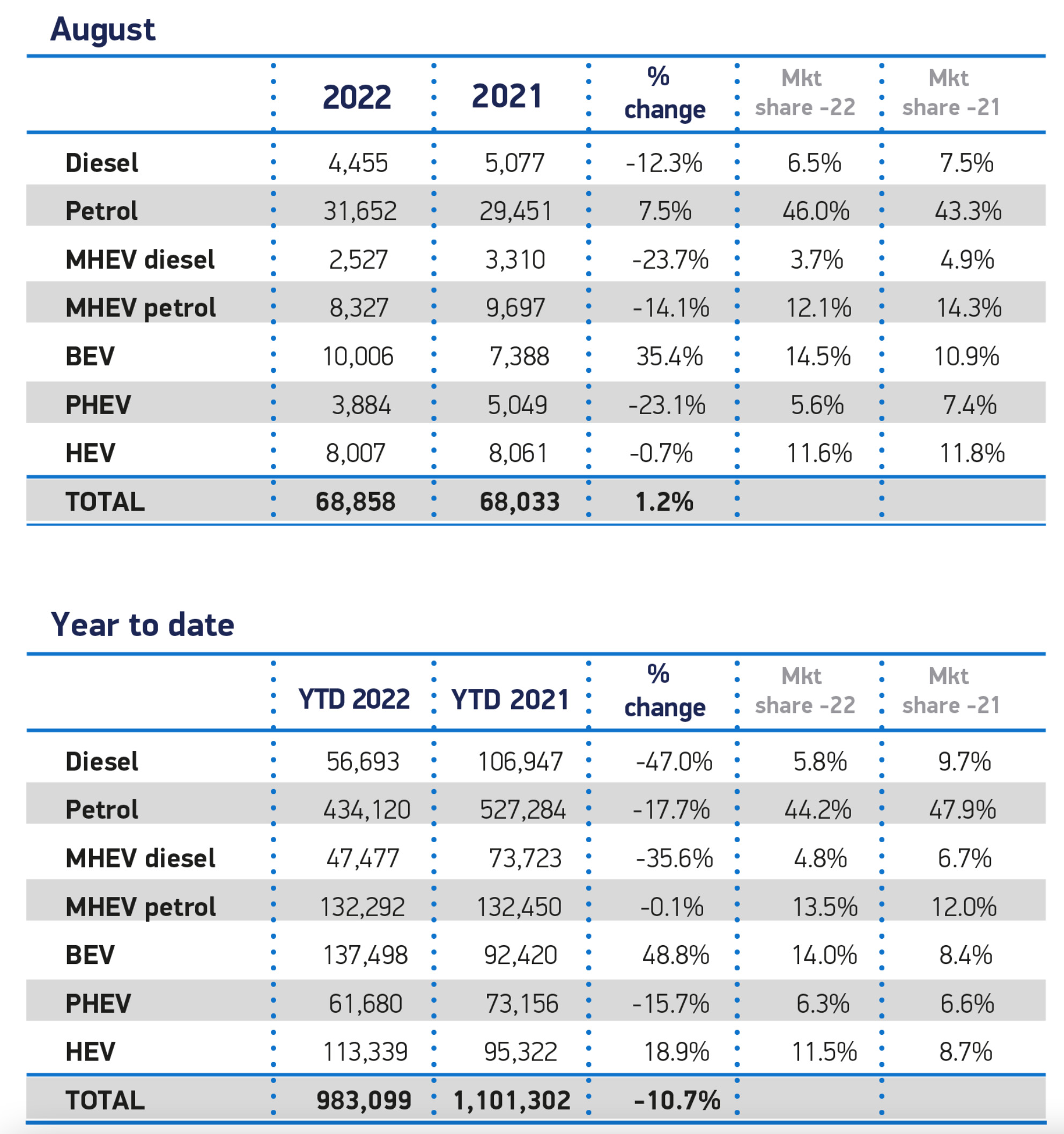

The UK new car market went up by 1.2 per cent in August, bringing an end to five months of decline it was revealed today (Sep 5).

A total of 68,858 new vehicles joined the road, figures released by the SMMT show – the first growth since February.

August is typically the second quietest month of the year as many buyers choose to wait for a ‘new’ numberplate in September.

But the industry trade body said that despite the growth, August volumes were still the weakest for the month bar 2021 since August 2013’s 65,937, as supply chain pressures continued to constrain the market.

Large fleet registrations fell by 1.6 per cent, although that was offset by a 3.2 per cent increase in deliveries to private consumers. Business customers saw the largest increase of 26.6 per cent, but the sector is small in volume and subject to volatility.

Overall growth in the month was driven primarily by battery-electric vehicles (BEVs), which recorded a 35.4 per cent increase in volumes and a 14.5 per cent market share.

However, growth in this segment is slowing, with a year-to-date increase of 48.8 per cent, whereas at the end of Q1, BEV registrations had been up by 101.9 per cent.

Plug-in hybrid (PHEV) registrations fell by 23.1 per cent to comprise 5.6 per cent of monthly registrations.

As a result, plug-in vehicles accounted for one in five (20.2 per cent) of August’s registrations. Hybrid-electric vehicle registrations stayed relatively stable, falling by 0.7 per cent.

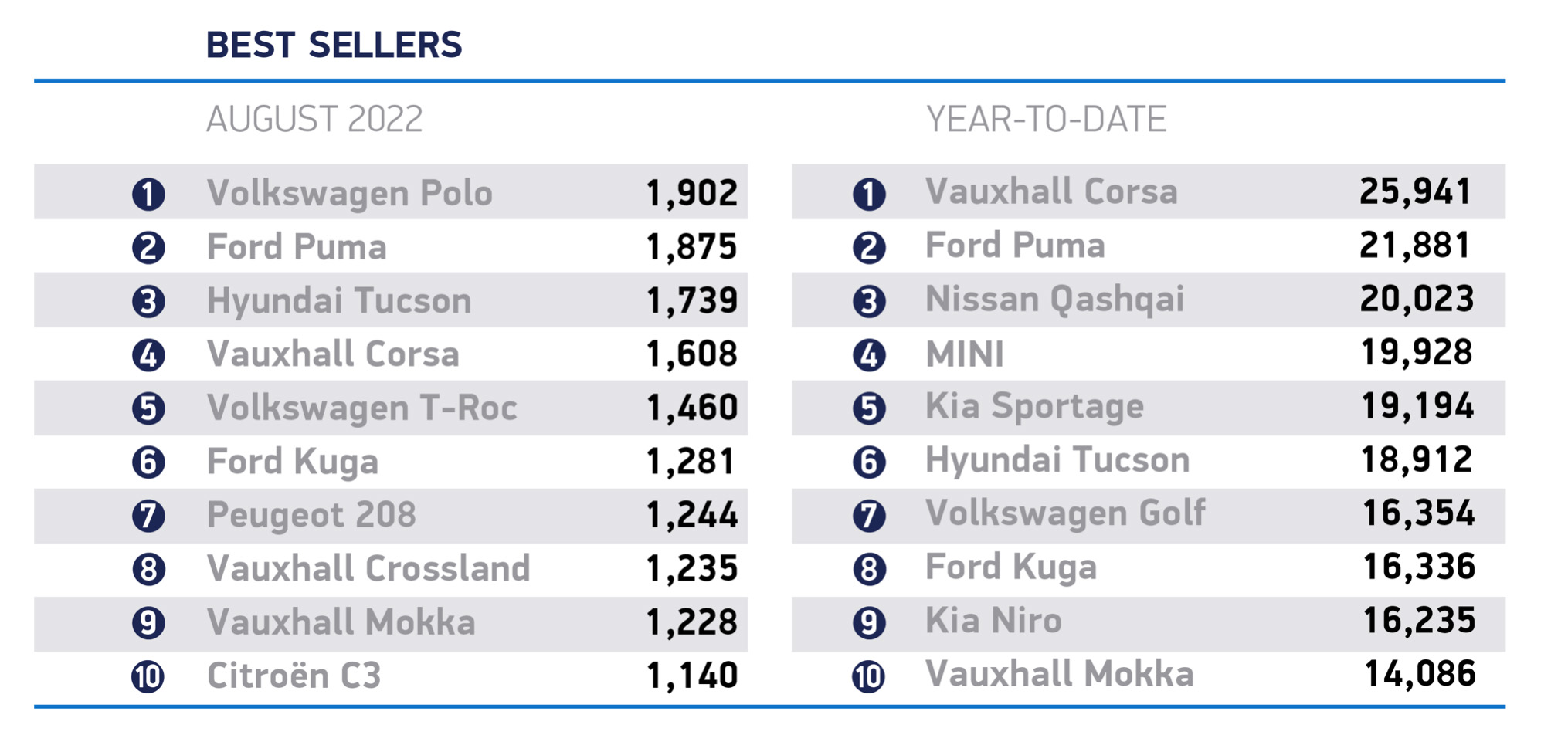

Superminis remained the most popular vehicle class, increasing their market share to 34 per cent as 7.4 per cent more of them were delivered to customers than in August 2021.

Multi-purpose, luxury saloon and lower medium vehicles also recorded growth of 31 per cent, 1.5 per cent and 1.3 per cent respectively, while registrations of all other segments declined.

Year to date, registrations are down by 10.7 per cent on last year at 983,099 units – more than a third (35.3 per cent) lower than during the first eight months of pre-pandemic 2019, which stood at 1,519,016.

The SMMT said that showed the scale of the challenge ahead in terms of recovery.

Mike Hawes, SMMT chief executive, commented: ‘August’s new car market growth is welcome, but marginal during a low-volume month.

‘Spiralling energy costs and inflation on top of sustained supply chain challenges are piling even more pressure on the automotive industry’s post-pandemic recovery, and we urgently need the new prime minister to tackle these challenges and restore confidence and sustainable growth.

‘With September traditionally a bumper time for new car uptake, the next month will be the true barometer of industry recovery as it accelerates the transition to zero-emission mobility despite the myriad challenges.’

The top three selling cars were the VW Polo (1,902), Ford Puma (1,875) and the Hyundai Tucson (1,739).

What the industry says

Momentum needs to continue

It’s terrific to see there was a small growth in new car registrations in August and that supply is beginning to come through to meet the demand we all know is out there.

However, August is traditionally a very slow month for new car registrations and so it’s likely we’ll see pretty much the same picture of supply struggling to keep pace with demand when we see September’s figures.

In reality, we’ll need the upward momentum to continue in September for the increase to be meaningful.

We all know that more and more people are choosing to switch to electric vehicles, but there was some uncertainty about whether rising energy prices, which have been in the news so much of late, would have an impact.

It’s great to see that’s not been the case and the same is true of the nearly-new market, where we have continued to see strong growth in volumes despite rising electricity bills.

Mark Carpenter, CEO, Motorpoint

EV sales are the only silver lining

The summer has not been kind to new car sales for the automotive industry.

The enduring impact of supply chain issues and the Ukraine conflict continues to restrict output and availability of new cars.

Coupled with rising energy prices, low consumer confidence and general economic uncertainty as the public waited for a new PM to be announced, it’s no surprise that sales have barely grown.

EV sales still represent the only silver lining to the clouds overhead. While they’re not as strong as earlier in the year, long wait times aren’t putting off car buyers keen to go electric as soon as they can.

Alex Buttle, co-founder, Motorway

Supply challenges still key factor holding back full potential

Despite the slight uplift, the SMMT’s sales figures highlight just how much the industry’s ongoing supply challenges remain the key factor holding back the full potential of the market.

But energy price rises are beginning to bite ahead of October’s surge in the energy price cap, and whilst sales growth continues, our data is beginning to show early signs of a waning of appetite for electric vehicles as buyers weigh up higher charging costs against running a traditionally fuelled vehicle.

Despite the looming rise in energy bills, electric vehicles are still much cheaper to run than petrol or diesel cars, with the average driver saving almost £100 per 1,000 miles.

The new prime minister needs to think imaginatively about ways to encourage EV adoption ahead of the 2030 ban on new diesel and petrol sales. That should include measures like bolstering the UK’s charging infrastructure, which is far too focused on the south-east.

Ian Plummer, commercial director, Auto Trader

Car industry remains on edge of precipice

While there are early signs that the production bottlenecks caused by the Ukraine war and semiconductor shortage are starting to ease, the UK car industry continues to sit at the edge of a precipice.

It faces the short-term crisis of a potential recession eroding new car demand and undermining the buoyant used car market, plus the potentially longer-term impacts of rising energy and raw material costs, all at a time when it needs to be investing unprecedented amounts in new electric car technology.

‘While the industry has risen admirably to the recent challenges it has faced, continuing doing so while facing huge financial pressures puts it under an unprecedented strain that threatens its ongoing success as a cornerstone of the UK economy.’

Jim Holder, editorial director, What Car?

Questions remain over buyer demand

The improvement in sales comes amid further signs of recovery in the supply of new cars, with the number rolling off UK production lines rising for the third consecutive month — a sign that component shortages may be easing.

Dealers struggled to meet buyer demand for new cars in the first half of the year, and any improvement in supply is a welcome relief.

However, questions remain over whether buyer demand will rise to meet that increasing supply, as the cost-of-living crisis is steadily reducing disposable incomes and affecting people’s willingness to make big financial commitments.

James Fairclough, CEO, AA Cars

Consumer behaviour changing as living costs rise

Delivery times for many sought-after models are starting to come down, with more manufacturers beginning to return to normal production schedules.

Our research shows that four in 10 buyers have been put off by these delays, so any improvement is welcome.

Car retailers are also seeing changing consumer behaviour as a result of rising living costs. Many drivers are moving from premium vehicles to cheaper, more fuel-efficient options.

This shift has become more apparent in recent months and is likely to continue.

Lisa Watson, director of sales, Close Brothers Motor Finance