Online used car dealer Cazoo posted a loss of £102m for the first half of 2021 – widening a loss of £31m in the same period last year.

In figures just released, Cazoo has also revealed how it performed during lockdown last year, as it compares this year’s performance to last.

It’s the first time Cazoo has revealed how it performed during the Covid-19 crisis.

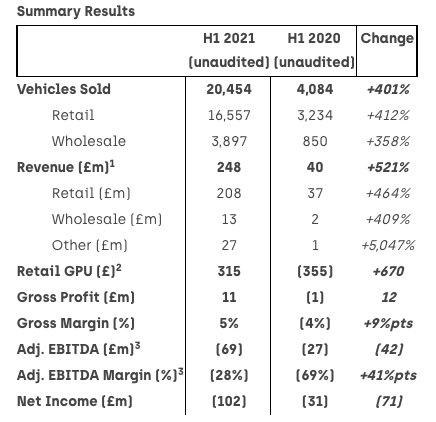

Cazoo sold just 4,084 cars in the first half of 2020 as the nation turned to online car buying in their droves.

As lockdown hit dealers and customers surged to dealers’ websites to buy vehicles, the used car group managed to sell just 3,234 cars online.

An additional 850 were sold to the trade in the same period.

Cazoo made a loss in that period of £355 on every car it sold to a retail customer.

During the first half of 2020, Cazoo generated just £40m in revenue – £37m of which came from selling used cars to retail customers.

The used car dealer’s fortunes have improved in 2021 as it managed to increase sales 401 per cent on the same period last year.

In the first six months of this year it sold 20,454 cars in total with 16,557 going to retail customers and 3,897 to the trade.

Revenue surged to £248m and it managed to squeeze £315 of profit out of each retail car it sold.

But it still posted losses up from £31m in 2020 to £102m this year.

Boss Alex Chesterman said: ‘We achieved record results in H1 with continued strong growth in revenue and gross profit per unit.

‘Consumers continue to embrace the selection, transparency and convenience of buying cars entirely online, generating record revenue of £248m during the half, up 521 per cent year on year.

‘Our gross profit per unit grew substantially during the first half, up £670 year on year, as a result of continued operational improvements.

‘We expect operational efficiencies to continue to drive further gross margin improvement and we remain on track to achieve revenue approaching $1 billion in 2021.’

Chesterman went on to explain that the acquisition of SFS and SMH, the reconditioning businesses, will help Cazoo overcome its biggest hurdle – prepping cars quickly enough for sale.

He said: ‘The biggest constraint we face is being able to recondition vehicles in the volumes required to meet consumer demand and this latest strategic acquisition will de-risk our future growth by doubling our capacity and significantly enhancing our team of vehicle preparation and logistics staff, giving us the ability to meet our growth aspirations over the next two years.’

Cazoo’s share price was down to 8.52 dollars today. Read the latest Cazoo stories here.