November saw the 20th consecutive month of used car price growth, increasing by a record 28.6 per cent on a year-on-year and like-for-like basis to reach an average price of £17,366.

That’s according to Auto Trader, which said the recent acceleration in used car prices had been so massive that the market has now recorded nearly five years of growth in just six months.

The average sticker price of a used car has gone up by some £3,400 since May – based on the used price trajectory between 2017 and May 2021, the market wouldn’t have expected to see the current average price until April 2026.

The results are the latest from the Auto Trader Retail Price Index, which is based on a daily pricing analysis of some 900,000 vehicles,

Auto Trader also highlighted the fact that more than a quarter (25.8 per cent) of nearly-new cars (up to 12 months) currently cost more than their new equivalents.

The previous all-time high was 22.8 per cent, recorded in October, and is more than six times higher than in January, when it was four per cent.

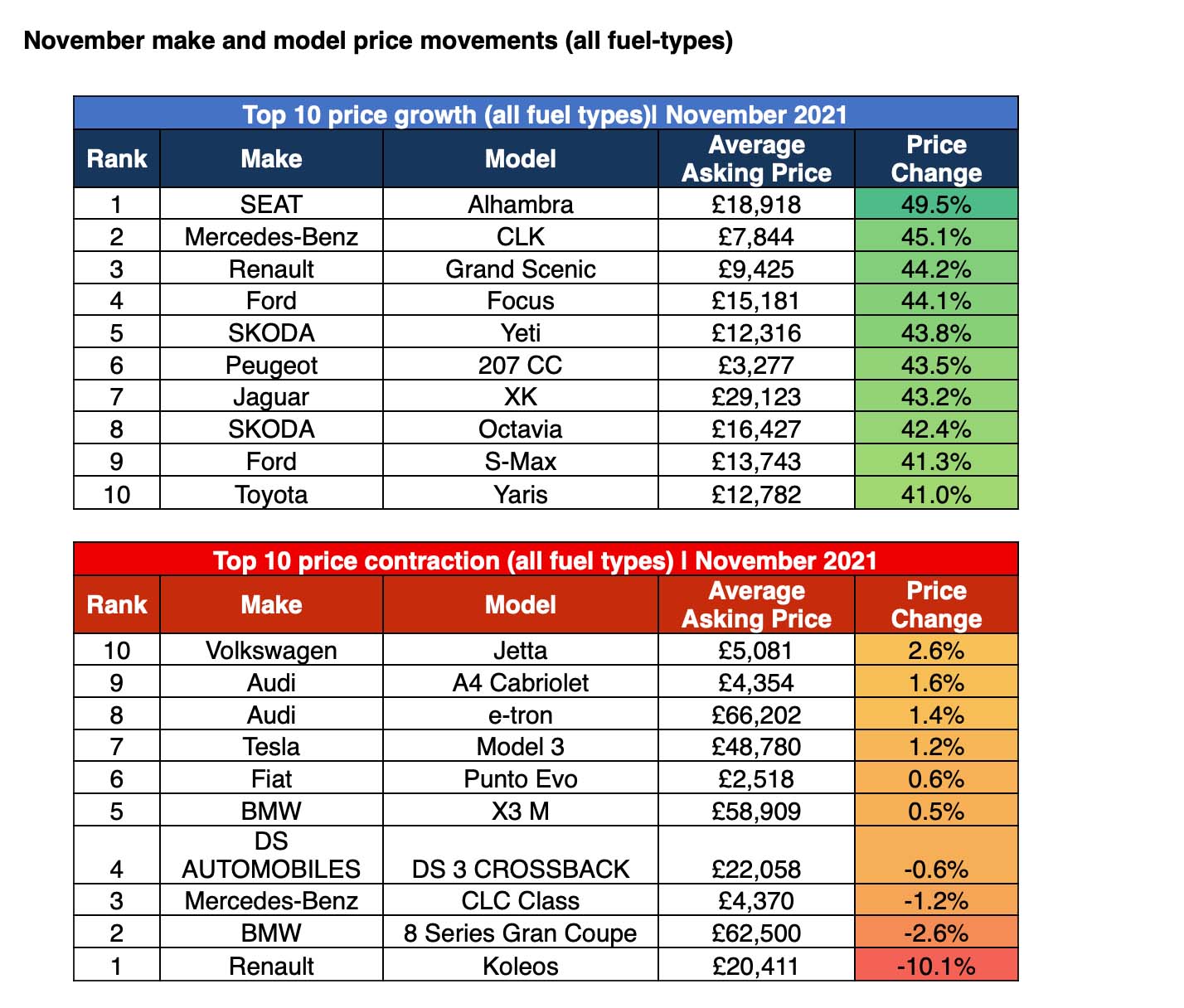

The Seat Alhambra, pictured, saw the largest year-on-year increase at 49.5 per cent, with an average asking price of £18,918.

Very high levels of demand coupled with low levels of supply were behind the ‘exceptional’ price growth, said Auto Trader.

The marketplace also saw a surge in traffic, with 56.9m cross-platform visits in November – a 23 per cent increase on November 2019. The length of time people spent researching their next car on the site also rose – up by 12 per cent, which was a total of 8.6m hours over the same period.

Supply was down some nine per cent last month versus November 2019, it said.

The average number of days a used car takes to sell went down in November, with used cars shifting 13 per cent faster than they were two years ago at 28 days versus 32 in November 2019).

Richard Walker, Auto Trader’s director of data and insights, said: ‘There’s been some suggestion that the period of huge price growth is coming to an end, or we’re finally about to see the “bubble burst”.

‘Beyond what we’d expect for this time of year however, we’re seeing absolutely no evidence of that being the case.

‘Although week-on-week price movements may continue to soften over the coming weeks, average prices remain nearly 30 per cent above what they were last year.

‘Looking further ahead, the new and used car supply constraints will last for much of next year, and with the economy set to grow, we can expect to see the very robust levels of consumer demand continue.

‘Simple economics therefore point to a continuation of very strong price growth well into 2022.’