The LCV market fell by more than a quarter to 17,566 registrations in the first month of 2022 versus a bumper January 2021, the SMMT said today (Feb 4).

But the trade body said that while the 26.9 per cent drop was the weakest start to a year since 2013, January has historically been a volatile month because of the intermittent nature of fleet renewal.

The decline followed the best January for 31 years in 2021, when new models and compelling deals saw registrations reach 24,029 units – up two per cent even on a pre-pandemic January 2020.

Figures for newly registered vans weighing less than or equal to two tonnes went down by 53.9 per cent, while medium-sized vehicles over 2.5 tonnes, which make up two-thirds of the LCV market, fell by 29.8 per cent.

Pick-up sales also declined – by 17.4 per cent – but 4x4s recorded a 196.8 per cent increase, although the SMMT said they were still a fractional segment.

Diesel remained the dominant fuel types, with a 94.3 per cent market share, but demand for battery-powered vans grew by 21.4 per cent with 647 units registered – 3.7 per cent of the overall market.

The SMMT predicts that electric van uptake will climb significantly in 2022, thanks to key new model launches.

It forecasts that the electric sector will rocket by 81.3 per cent to 23,130 units, representing 6.4 per cent of the market and versus 3.6 per cent or 12,759 units in 2021.

This means that roughly one in 16 new vans will be fully electric in 2022.

It also believes that the LCV sector will grow overall by two per cent this year to 362,620 units. That would put the market just shy of the 365,778 vehicles registered in 2019.

Meanwhile, the growth is expected to continue in 2023 at 387,420 registrations, and electric van registrations are predicted to rise a further 57.6 per cent next year to a market share of 9.4 per cent.

SMMT chief executive Mike Hawes said: ‘Despite the slow start, the van market is expected to post another strong year.

‘While chip shortages, rising inflation and increased energy costs will have an impact, growth is still anticipated, given the inexorable rise of home deliveries and broader economic recovery.

‘With more battery-powered vans coming to market, the demand for these new technologies seen in January is likely to continue across the year.

‘With uptake rates still lagging the new car market, which has the same end-of-sale date, the importance of bringing every lever – purchase incentives, fiscal measures and recharging infrastructure investment – to bear on this critical sector is self-evident.’

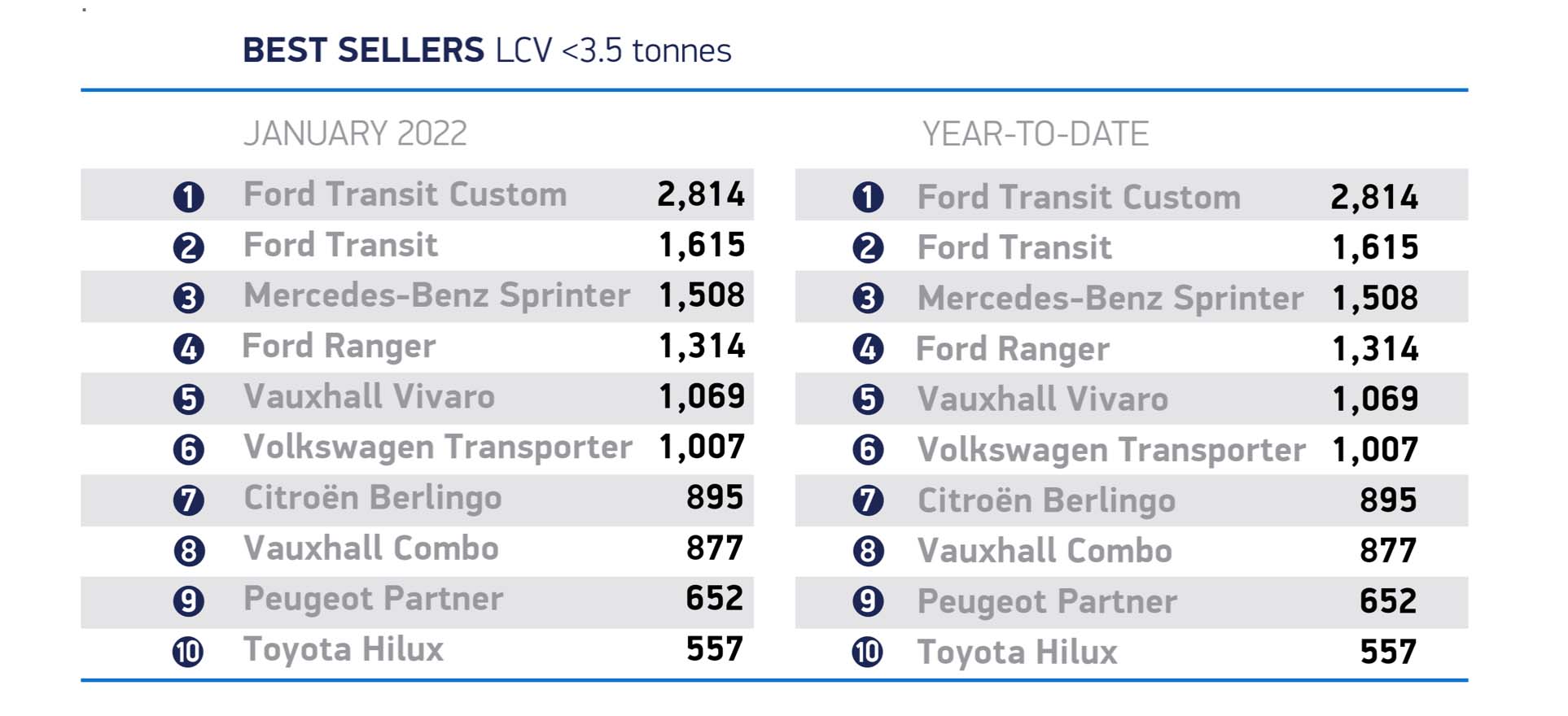

January’s top-selling LCV was the Ford Transit Custom at 2,814 units, with the Ford Transit following at 1,615 and the Mercedes-Benz Sprinter, pictured, in third place at 1,508.