A struggling firm that offered investors returns of up to 11 per cent on sub-prime car leases has gone into administration.

Buy2LetCars, which is a subsidiary of the Raedex Consortium, was already banned by the Financial Conduct Authority from starting new business in February because of worries over its finances.

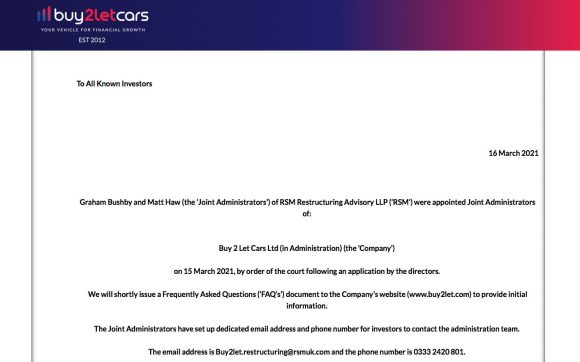

But now administrators have been appointed for Raedex and its offshoots, reports The Times.

It means that thousands of people could lose their money depending on what the appointees from RSM Restructuring Advisory are able to do.

Money ploughed into Buy2LetCars was used on new vehicles, which were leased to people who had poor credit.

Investors, who were offered up to 11 per cent over three years, were paid from the drivers’ monthly payments.

Raedex is still trading and people leasing a car are being told to carry on paying.

Its last available accounts – for the year ending December 31, 2019 – showed it was £10.8m in the red and it has assets worth £5.3m said The Times, with those assets basically being its cars.

Investments in Buy2LetCars, which was established in 2012, are unregulated, which means complaints can’t be made to the Financial Ombudsman Service.

According to The Times, an anonymous campaigner raised concerns about the firm with the FCA in June 2019 and then again in January this year when it looked like no action had been taken.

The FCA is reported to have ‘engaged with the firm on a number of occasions’ though, and The Times said it had approached Buy2LetCars’ directors for comment.