Motor trade analysts have upgraded their forecasts for Lookers as the dealer group continues to turn a corner.

Respected analysts Zeus Capital have suggested the dealer group could achieve a share price of 100p in the ‘medium term’, and notes the group’s share price is continuing to rise.

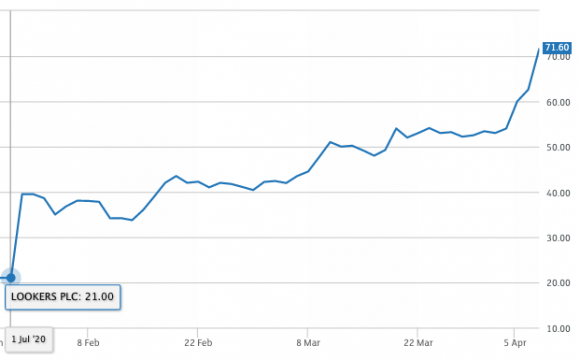

When trading was suspended in July last year after a series of delays to its financial results, shares were priced at just 21p.

The group was relisted on the London Stock Exchange on January 29 and the share price immediately almost doubled to 39.5p.

Following yesterday’s unscheduled announcement to the Stock Market revealing resilient performance for the first quarter of 2021, the share price jumped again, trading at 71.6p last night.

In a note to investors, Zeus Capital said it was now increasing its forecast for the group’s profit to £34.2m in 2021 and £48.1m in 2022.

The Lookers share price has risen from 21p in July last year. Source: LSE

Mike Allen, Zeus Capital analyst, wrote: ‘Since our last note, the share price has increased 70 per cent from 41.8p.

‘We think this still presents good value to investors. Further, with the improved forecasts, our blue-sky analysis suggests that a medium-term price target of over 100p is achievable.

‘We anticipate results to be announced in May this year and are also conscious that a bank refinancing has to take place as well.

‘Despite the recent share price gains, we continue to believe the long term risk/reward profile remains positive from here.’

Analyst Peel Hunt also told investors yesterday that it was also upgrading its profit before tax forecast for Lookers by 47 per cent – up £11m to £34.8m.

Lookers said that despite its dealerships being closed for the first quarter of this year it still managed to sell 44,000 new and used cars – down from 49,000 in the same period last year when showrooms were open and the pandemic was yet to truly bite.

No financial figures were revealed but Lookers said it expected profit for 2021 to be ‘materially ahead’ of analysts’ predictions.

£34.8m

Peel Hunt’s prediction for Lookers 2021 profit

Zeus Capital’s note said investors were starting to see the benefits of the group’s ‘investment in technology and process improvements’.

Allen added: ‘Through its enhanced online capabilities, Lookers was able to continue to fulfil demand via its digital channels.

‘Against the industry-wide 12 per cent YoY decline in Q1 2021 published by the SMMT this week, Lookers’ new car sales were flat like-for-like. Used car sales were down six per cent YoY, which was offset in part by improving margins.’

Lookers timeline: What’s happened when?

Click on the date to read the full story

April 8, 2021 – Lookers reveals its performance for first quarter of 2021 was ahead of board expectations in unscheduled announcement to Stock Market.

March 18, 2021 – Lookers said it expects to make a profit before tax of around £10m for 2020 – up from £4.2m for 2019 as it reveals talks with banks are ‘progressing’.

March 15, 2021 – Lookers’ previous auditors Deloitte under investigation by Financial Reporting Council of its work on the group’s accounts in 2017 and 2018.

March 2, 2021 – FCA investigation closed and no fine imposed on Lookers. FCA expressed ‘concerns’ relating to ‘historic culture, systems and controls’, but said no further action would be taken.

January 29, 2021 – Lookers revealed it lost £36.1m in the first half of 2020. The interim results led to shares being relisted on London Stock Exchange. They immediately rose 77 per cent.

January 6, 2021 – Lookers appoints Anna Bielby as interim chief financial officer, but there was no news on the delayed interim results.

December 29, 2020 – A third of shareholders vote against Lookers directors’ remuneration packages – including CEO Mark Raban’s £450k salary – at a general meeting.

December 18, 2020 – Lookers tells investors that its interim results, promised to be delivered before the end of the year, will now not be published.

December 9, 2020– Lookers reveals interim CFO Jim Perrie has quit early and says it is ‘unlikely’ the interim results will be out before the end of the year.

November 25, 2020 – Lookers finally releases its annual accounts for 2019 showing a statutory loss for 2019 of £45.5m. Promises interim results in December and the hopeful reinstatement of shares on Stock Market.

October 31, 2020 – Long-standing Lookers non-executive director Tony Bramall, one of the group’s major investors, brings forward the date he will leave the board to the end of December. No reason is given for his early departure.

October 19, 2020 – Lookers updates market on performance in Q3, but still no word on its 2019 accounts or the FCA investigation. Analysts expect results to be out before December.

August 20, 2020 – Accounts delayed for fourth time and no promise given as to when they’ll be published.

June 9, 2020 – Lookers says it will suspend shares on July 1. Delays accounts for third time and says they’ll be published ‘no later than the end of August 2020’.

June 5, 2020 – Lookers says it will axe 12 dealerships and cut 1,500 jobs.

May 2020 – Pendragon CEO Bill Berman admits he wrote to Lookers to discuss a merger and updates Stock Market to that effect. Move described as ‘two drunk men bumping into each other in a bar’.

April 2020 – Fraud investigation deepens. £4m charge revealed and firm says there could be more. Delays accounts to June.

March 12, 2020 – New chief operating officer Cameron Wade leaves role after only a month in post.

March 11, 2020 – Lookers delays results, saying that in final stages of preparation ‘potentially fraudulent transactions’ in one division were discovered. Promises results in April.

November 2019 – Chief executive Andy Bruce and chief operating officer Nigel McMinn leave firm abruptly.

June 2019 – FCA launches review into sales processes at Lookers between January 2016 and June 2019. Lookers cannot ‘estimate what effect, if any, the outcome of the investigation may have’.

December 2018 – Lookers launches independent internal audit into sales process. It eventually finds ‘control issues’ in sales process where ‘improvements’ are needed. Findings handed to FCA.