The UK’s new car market grew for the second month running in September, with registrations rising by 4.6 per cent according to the latest figures released today by the SMMT.

A total of 225,269 cars joined Britain’s roads during what is typically the second biggest month of the year for the sector.

But although it was 9,957 units up on last year – when the industry recorded its weakest September since 1998 at 215,312 units – overall registrations for the month were still some 34.4 per cent below pre-pandemic levels, as September 2019 saw 343,255 new cars registered.

On the bright side, EV uptake continued to rise, albeit at a slower rate than earlier in the year, with the second-highest monthly volume of battery-electric vehicle (BEV) registrations in history – up 16.5 per cent to 38,116 units.

But although registrations of plug-in hybrid vehicles (PHEVs) declined by 11.5 per cent to 12,281 units, overall plug-in vehicles accounted for more than one in five new cars joining UK roads in the month.

As a result, nearly a quarter of a million (249,575) have been registered in 2022 – meaning UK drivers and fleets have now registered more than one million plug-in EVs.

September also saw Britain’s millionth plug-in electric car registered, with the SMMT saying total BEV and PHEV registrations from January 2010 to September 2022 stood at 1,002,157.

Hybrid-electric vehicle (HEV) registrations grew by 16.5 per cent to 29,088 units.

Petrol-powered cars grew 4.3 per cent to 126,873 units and diesels declined by 14.5 per cent to 18,911.

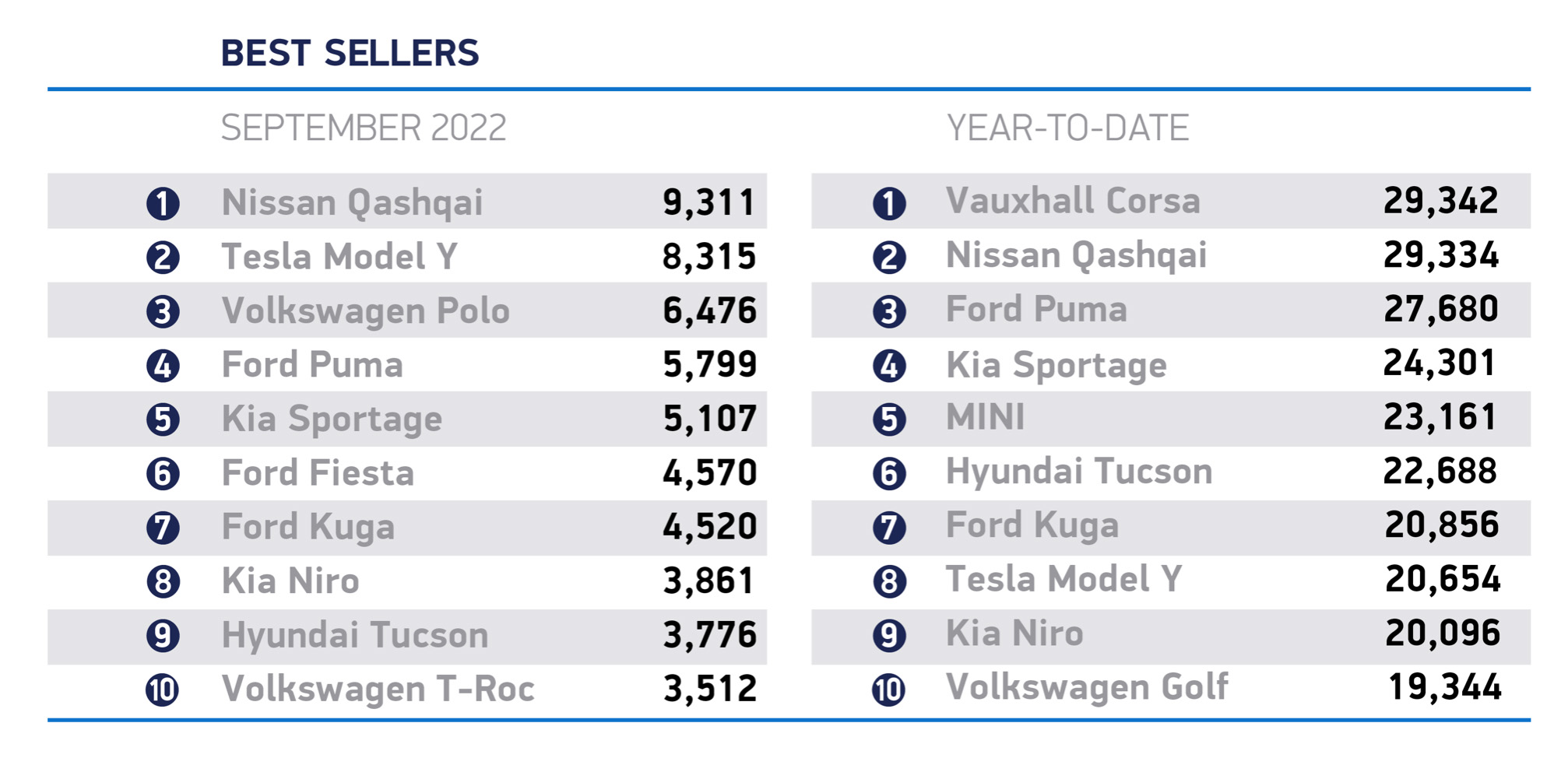

September’s top-selling car was the Nissan Qashqai at 9,311 units, followed by the Tesla Model Y (8,315) and Volkswagen Polo (6,476).

The industry is continuing to battle supply issues to fulfil a backlog of order, said the trade body, but registrations by large fleets grew by 12.5 per cent or 11,315 units, bucking recent trends.

However, the SMMT said that was still a significant decline on pre-pandemic volumes at 39.7 per cent. Registrations to private buyers, meanwhile, fell by 3.6 per cent.

Total registrations for 2022 are also down 8.2 per cent on a weak 2021 performance and more than a third (35.1 per cent) below the first three-quarters of pre-pandemic 2019, equivalent to 653,903 fewer units.

SMMT chief executive Mike Hawes said: ‘September has seen Britain’s millionth electric car reach the road – an important milestone in the shift to zero-emission mobility.

‘Battery-electric vehicles make up but a small fraction of cars on the road, so we need to ensure every lever is pulled to encourage motorists to make the shift if our green goals are to be met.

‘The overall market remains weak, however, as supply chain issues continue to constrain model availability. Whilst the industry is working hard to address these issues, the long-term recovery of the market also depends on robust consumer confidence and economic stability.’

What the industry says

Government must actively help

The semiconductor shortage that has plagued the sector since Covid is continuing to ease, although remains far from over.

The main concern is now the cost-of-living crisis. Research conducted by What Car? in September found 40 per cent of in-market buyers have delayed their vehicle purchase due to rising prices and uncertainty.

The government can and should play an active role in helping buyers and dealers.

Jim Holder, editorial director, What Car?

EVs provide glimmer of sunshine

Anyone who was expecting the traditional spike in new car uptake in September to coincide with ‘new’ number plates will be sadly disappointed.

With widespread concern about spiralling energy costs, inflation and now mortgage increases, combined with continued supply chain issues, can we really be surprised at the marginal growth in new car sales?

The glimmer of sunshine peeking through the rain clouds is EV sales which continue to stay strong.

Alex Buttle, co-founder, Motorway.co.uk

Positive performance of fleet channels worth noting

It’s positive to see some year-on-year sales growth and we are on the cusp of a period where trading is showing early signs of returning to pre-pandemic conditions.

But considering September is a plate-change month – typically one of the busiest periods on the calendar – sales are still around a third below pre-pandemic levels in 2019, as production issues continue to stifle sales.

It’s worth noting the positive performance in the fleet channels, which have largely been overlooked recently in favour of more profitable retail sales.

Although we’re still a long way off rental companies being able to renew all of their fleets, it does mean that those motorists on leasing contracts will begin to see better signs of supply to renew their cars.

Ian Plummer, commercial director, Auto Trader

Potential for dip in consumer confidence

We’ve seen some encouraging signs for the automotive sector in recent months. Waiting times are coming down, but economic headwinds are clearly building.

While there is still strong demand from car buyers, many are adapting their wish lists based on market conditions. Some families and small business owners are also choosing to hold on to their existing vehicles for longer than they might have planned.

With potential for a dip in consumer confidence towards Christmas, it’s vital that retailers are using all the insight available to fill their forecourts with the stock consumers are looking for.

Lisa Watson, director of sales, Close Brothers Motor Finance

Dealers can’t relax just yet

September’s change in registration plates is an acid test for the new car market – and on this evidence, it has passed comfortably.

Total sales in September were up a welcome 4.6 per cent compared to the same month last year, and sales of EVs continue to go from strength to strength – more than a million have now been sold in the UK.

Yet few car dealers will relax just yet. Supply shortages have held back new car sales for much of 2022, and overall sales for the first nine months of the year are still 8.2 per cent down on the same period in 2021.

However, there are some welcome signs that the supply problems are easing.

James Fairclough, CEO, AA Cars