Vertu Motors expects its performance for the year to ‘beat market predictions’ after a strong first half of 2022.

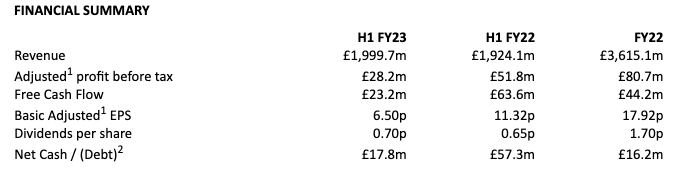

Unveiling results for the six months ending August 31, Vertu Motors revealed profit before tax of £28.2m on revenue of nearly £2bn.

New and used car margins helped to boost the group’s results, despite supply issues.

Last year in the same period, Vertu racked up profits of £51.8m – but boss Robert Forrester said at the time this ‘would never be repeated’.

Revenue for the first half of this year grew 3.9 per cent and the firm believes it is now the fourth largest car dealer by revenues.

The better than expected performance comes after the group warned in September that it was likely to finish the year in line with predictions – this update reveals the group have actually performed even better than first thought.

And hinting at further growth to come, the firm said it had a ‘strong acquisition pipeline’ in place.

CEO Forrester, who will be speaking to Car Dealer Live this morning, said: ‘The first half has seen a strong trading performance with vehicle margin strength offsetting market driven volume shortfalls.

‘Cashflow generation has been strong and the dividend for the first half has increased again.’

Our interview with Forrester will be added to this story later this morning.

Vertu also said it would be upping its interim dividend of 70p per share, up for 65p, for the first half of 2022. It will be paid in January.

The results were helped as new and used car supply issues were offset, says Vertu, by ‘continued higher margins’.

And the firm said it performed well in September – the key plate change month – despite new car supply constraints.

Brokers Liberum said they believed the trading environment will ‘remain robust’ but cost pressures will be ‘the big variable’

However, the analysts maintained its ‘buy’ position and said it believed Vertu was ‘well-positioned to consolidate the market’.

Zeus Capital’s Mike Allen added: ‘Vertu delivered a strong set of H1 results, the second highest on record, despite a deteriorating economic environment and clear cost headwinds to contend with.

‘The group is well capitalised and we anticipate continued execution on its well established strategy over the coming months.

‘We are raising our FY23 EPS forecasts by 13 per cent post these results, and continue to believe the shares remain considerably undervalued based on significant financial firepower, asset backing and strong execution of the Group delivered to date.’

Vertu’s numbers in detail

Vertu said it would benefit from government actions to reduce National Insurance rates, announced in the recent mini budget, and from help on energy rates.

The dealer group had a fixed energy price deal for electricity that ended last week.

Vertu explained that cost is a ‘key management focus’ and that there were clearly cost pressures ‘evident’ in particular energy prices. However, it said a strategy was being developed including capital investment.

While no details were announced on any acquisitions, the group hinted there was more to come soon.

Chairman Andy Goss said: ‘The group has the scale and firepower to take advantage of the considerable sector changes working in partnership with the group’s manufacturer partners through accretive consolidation of this fragmented market.

‘The group’s excellent financial position, continued investment in its colleagues and systems and its established track record of execution gives me confidence that we will continue to deliver on our strategic objectives.’

Vertu posted record profits of £80.7m last full year.

Revenue for the year stood at £3.61bn and the group sold 166,823 cars, of which 78,000 were new.