I have been working with a franchised dealer group in the south-west for the past year or so, helping to improve used car performance at one of its largest sites.

As that project is coming to a close, I was asked by the owner if I felt that there were still any areas of significant improvement left.

With the exception of organic improvement through coaching and team development, I felt happy to say that on the whole the site is working at a high level.

However, I feel there is a tremendous amount of untapped potential for this and many franchised dealerships all over the country.

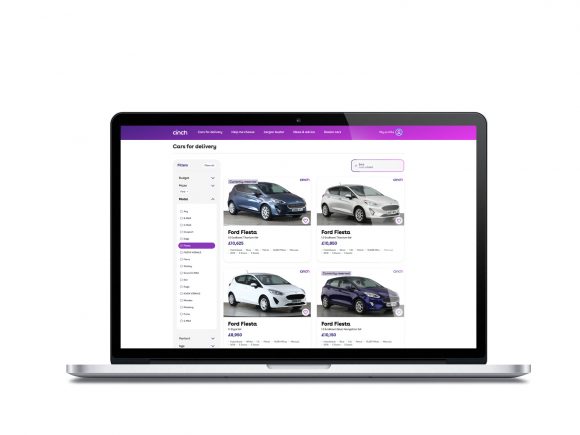

I have written frequently of late about the impact of online retailers such as Cazoo, Cinch and Carzam on the wider market, saying that there is no direct threat to established franchised operators.

Having thought about the subject further, I am now of the belief that there is more to gain than there is to lose.

Think about the things that good traditional franchised operators offer a consumer (assuming normal trading conditions without the impact of a global pandemic).

The first and most obvious is location.

Although Cazoo and Carzam have some physical infrastructure, most franchised retailers have been long established in their respective territories and have the premises to offer a comfortable viewing and test-drive experience.

I think retailers are slowly changing the role of the sales executive to become more experiential, but some fundamentals remain.

Many consumers, although influenced by their research on the internet, still need to be sold to. Online retailers do not have this luxury.

For example, how many consumers visit dealerships thinking they need a hybrid or electric vehicle but with consultative selling can be shown that the cost and practicality make the option less attractive?

Dealers operating in a face-to-face environment also have the ability to capture data, build relationships and follow up with new offers or stock. This is to say nothing of the expertise that comes with having specific brand knowledge and technical information.

So assume (dangerous, I know) for one moment that dealer groups all over the country have taken note of the success of the interactive nature of Cazoo’s website and are frantically building equivalents that allow for more photographs, better live chat facilities and video production. Where is this next opportunity?

The first thing I did when I arrived here was to analyse the complete sales performance for the previous 12 months.

What was apparent – and there are no surprises here – was that the profit performance for cars over three years old was half that of cars up to two years old.

The mechanical preparation, warranty and paint repair cost for those cars was prohibitively expensive, so I set about reshaping the stock profile to favour more profitable younger cars.

Some older cars were retained, but they were limited to SUV and performance models.

I understand that for some dealers with more mainstream franchises, preparation costs are not as keenly felt as some premium brands, but the issue still exists.

I cannot stress how strongly I believe in the need for franchised dealers to sell older cars, but it is not their sole responsibility.

In fact, it is up to the manufacturers to lead the way to make the concept viable.

Firstly, warranty costs need to come down. I understand that burn rates dictate warranty prices, so perhaps it is time for manufacturers to reduce the standard time period afforded to approved cars and offer consumers the opportunity to extend.

For example, online retailers offer six months’ warranty to sit alongside the mandatory period given to customers by the Consumer Rights Act, so why can’t manufacturers do the same?

I know the level of coverage will be significantly different, but we are in a world where travellers are happy just for their seat on the plane and will forego their meal.

Manufacturers may be concerned about the reputation of their brand if cars suffer failures beyond a six-month period or if coverage results in a failed claim, but that argument will not sit well with a prospective buyer looking to spend thousands on their product and therefore want the manufacturer to back its older cars.

Secondly, parts – especially consumable items – need to be discounted for older cars.

Manufacturers are reluctant to offer different discount structures for identical part numbers depending on vehicle age, as they will be concerned retailers will take advantage, but they must develop technological solutions to overcome this.

Online retailers are using pattern parts with significant savings and franchised dealers must be more competitive.

Similarly, service and wear-and-tear requirements must be similarly flexible to combat the online retailers.

There is also a mutual responsibility on behalf of retailers to make this work. Budgeting internal labour and parts sales at retail rates must be a thing of the past.

In reality, the need to target older cars has as much potential for replacing lost service parc penetration as any lapsed service campaign.

The analogy I used for this business is that aftersales businesses are experiencing a carbon monoxide-like poisoning from electrification and the homogenisation of cars.

It is happening but we cannot see it. Internal preparation is masking the impact of online retailing, affording no brand loyalty to franchised service departments.

Sales processes need to be adapted to manage expectations effectively, both for the online and physical customer. Implying that a used car is perfect must be a thing of the past.

That’s not to say that retailers should try to get away with daylight robbery, but stone chips, small dents and scratches must be brought to the attention of the customer prior to sale.

The alternative that many groups favour is to create alternative retail sites for older cars with a different trading name to distance themselves from problems, but the sad reality is that franchised sites are under threat unless the current modus operandi is changed.

Thinking positively, in my opinion the future for franchised used car retailing is in the hands of manufacturers and dealers and not in the hands of online disruptors.

It will take complete and open-minded collaboration on the part of all stakeholders to make it work.

James Litton is an automotive retail consultant who always has something to say about the industry he loves.