Marshall Motor Group has announced the acquisition of dealer group Motorline in a deal worth £64.5m.

The purchase – the biggest for Marshall since it bought Ridgeway – will take the group to a £3.2bn annual turnover.

The deal was for a cash consideration of £64.5m funded by the group’s existing cash resources.

Separately the group acquired freehold property for £2.9m and has the option to buy two additional freehold properties for £24.9m.

Motorline is a 48 dealership group based in Canterbury, Kent, and will see some 1,500 employees join the Marshall team.

The deal – which the Marshall team have been working on for eight months – will add 19 Toyota and Lexus sites to the group, the first time Marshall have represented the brand.

It will make Marshall the second biggest partner for the Japanese brand, behind Steven Eagell.

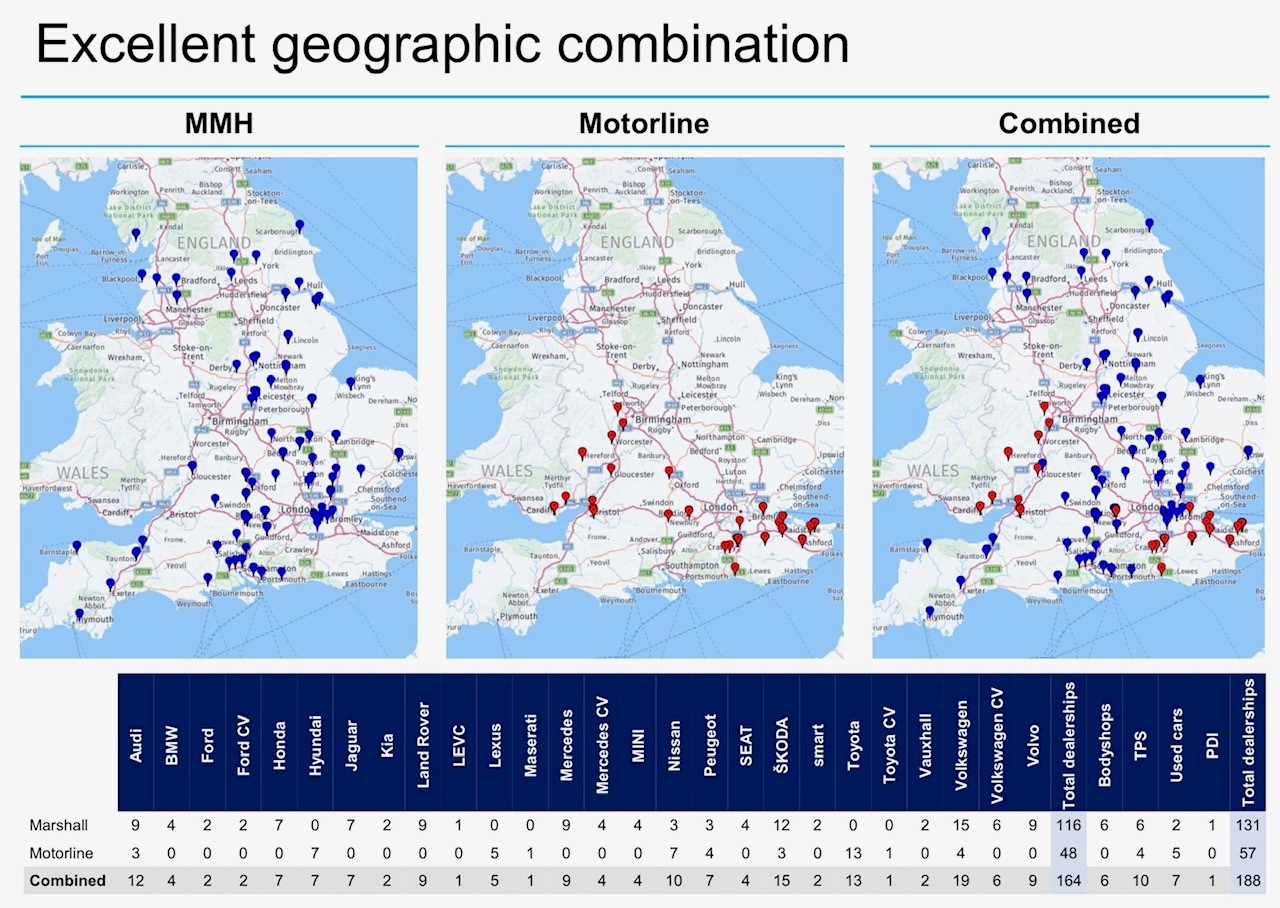

Seven Hyundai sites, four Volkswagen, three Audi and three Skoda dealers will be rebranded Marshall as well as seven Nissan, four Peugeot and a Maserati site.

Motorline – which was 34th in the Car Dealer Top 100 list of most profitable dealers last year – made £6.96m EBITDA profit on turnover of £717m in 2019.

It made 0.4 per cent return on sales and Marshall, which finished fifth, made one per cent – giving boss Daksh Gupta and his team plenty of space to make a return on their investment.

Motorline’s four Volkswagen Trade Parts Specialists sites and five used car sites will also become part of the Marshall family.

Motorline, founded in 1972, is mostly based in the Kent area and will increase Marshall’s foothold in the south east.

Slide shows the larger area now covered by Marshall

Revenue for Motorline to the end of December 2020 was £695m and profit before tax was £6.1m.

Marshall CEO Gupta said: ‘We are delighted to announce the acquisition of Motorline in line with our strategy which includes growing both further scale with existing brand partners and developing scaled relationships with selected new brand partners.

‘Motorline is an extremely well-respected, long-standing business. The Obee family have overseen a significant expansion of the business in recent years and have invested in a market-leading property portfolio.

‘The acquisition has been funded from existing cash resources and is expected to generate attractive financial returns for our group.

‘We are delighted to begin new and significant partnerships with Toyota/Lexus and Hyundai. These brands, with a combined market share in the UK of over 11 per cent, have been a target for the group for some time and the acquisition of Motorline provides immediate scale with each of them.

‘I would like to thank each of them for supporting this acquisition and very much look forward to working with them over the coming years to develop a mutually successful partnership.

‘I would also like to take the opportunity to thank our existing brand partners for their continued support for the further growth and development of the group for which we are extremely grateful.

‘Finally, and most importantly, I would like to welcome our 1,500 new Motorline colleagues to the group. I look forward to meeting you soon and to working with you over the coming years.’

More coming

David Kendrick, partner at UHY Hacker Young, who advised on the deal added: ‘Having worked with the Obee family for over a decade, I am delighted to have assisted the shareholders on the sale of their substantial group.

‘The business has grown a huge amount over the last decade to 48 dealerships and not only introduces Toyota and Lexus to the Marshall portfolio, but also significantly increases their footprint across the UK.

‘One of the biggest deals done in a very long time and it remains a very active market elsewhere too!’

Motor industry analyst Mike Allen, of Zeus Capital told shareholders he now thinks the group is ‘undervalued’ in a note this morning.

He wrote: ‘MMH has a long track record of successful execution and integration of acquisitions – we are confident that this “off market” transaction will complement MMH’s already strong and reliable platform.

‘With our upgrade to FY21 earnings last week and the upside that this new business will add, our view is that the shares are considerably undervalued.’

Mike Jones, compiler of the Car Dealer Top 100, and automotive industry expert, added: ‘This represents a great acquisition for Marshall Motor Group, adding two key franchise partners and deepening relationships with others.

‘This transforms Marshalls into a £3bn+ turnover company, instantly adding profit, whilst continuing with the strategy of being a significant player with their key brand partners, which now include Toyota/Lexus and Hyundai.’

The latest Car Dealer Top 100 list of most profitable car dealers will be published soon.