The new car market grew by nearly 15 per cent last month to reach 131,994 units – the best start to a year since pre-Covid January 2020.

Figures for January 2023 – released this morning by the SMMT – marked the sixth month of expansion in a row and set the tone for an anticipated counter-cyclical year of growth, according to the trade body.

The UK new car market grew by 14.7 per cent, with electrified vehicles notably driving the increase, thanks to manufacturers bringing more choice to the market in spite of continuing supply chain struggles.

Hybrid electric vehicles (HEVs) comprised 14.4 per cent of new car registrations, increasing volumes by 40.6 per cent, with a figure of 18,976 units.

Meanwhile, battery electric vehicle (BEV) registrations rose by 19.8 per cent to reach 17,294 units, or 13.1 per cent of new registrations – slightly below the average for 2022.

Plug-in hybrid vehicles (PHEVs) recorded a 0.7 per cent rise at 9,109, although their share fell to 6.9 per cent of new cars reaching the road.

As a result, one in five new cars registered in the month came with a plug.

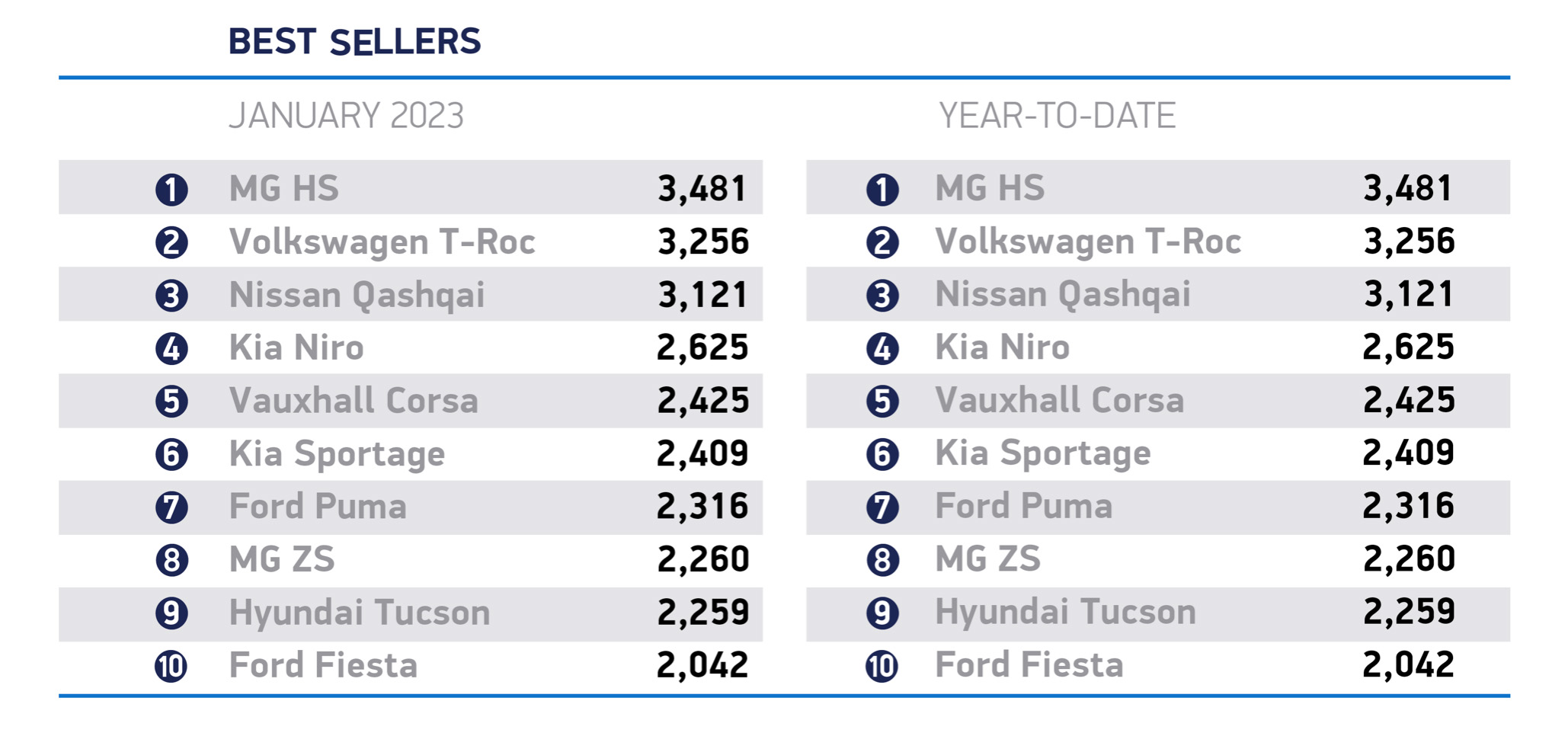

The top-selling car was the MG HS at 3,481 units, closely followed by the Volkswagen T-Roc (3,256) with the Nissan Qashqai third (3,121).

It was also a strong month for large fleet registrations, which rose by 36.8 per cent to 69,540 units, while registrations by private buyers fell by 4.3 per cent to 59,639 units.

That, said the SMMT, reflected some easing of supply and evidence of how shortages last year distorted market performance.

Plug-ins are anticipated to comprise more than one in four new registrations this year, representing growth of 32.1 per cent or approximately 487,140 units and nearly a third (31 per cent) of the market in 2024 at 607,150 units.

However, the SMMT repeated its warning that the roll-out of infrastructure needed to charge them was failing to keep pace.

During the last quarter of 2022, the ratio of new chargepoint installations to new plug-in car registrations dropped to one for every 62 – a significant fall, it said, versus the same quarter last year, when the ratio was 1:42.4.

As a result, in 2022, one standard public charger was installed for every 53 new plug-in cars registered – the weakest ratio since 2020.

The SMMT said the upcoming Budget on Wednesday, March 15 was an opportunity to put in measures that supported the transition.

It wants to see VAT on public chargepoint use cut from 20 per cent to five per cent in line with home charging. That would ensure more affordable access for all and underpin a fair net zero transition, it said.

The SMMT also wants the government to review proposals to graft a vehicle excise duty regime designed for internal combustion cars on to zero-emission vehicles (ZEVs).

It said the higher production costs associated with EVs means that currently more than half of all available BEVs would be subject to the expensive car supplement due to apply to ZEVs from 2025.

Although it recognised that all drivers should pay their fair share, it said existing plans would unfairly penalise those making the switch, and risked disincentivising the market at the time when EV uptake should be encouraged.

SMMT chief executive Mike Hawes said: ‘The automotive industry is already delivering growth that bucks the national trend and is poised, with the right framework, to accelerate the decarbonisation of the UK economy.

‘The industry and market are in transition but fragile due to a challenging economic outlook, rising living costs and consumer anxiety over new technology.

‘We look to a Budget that will reaffirm the commitment to net zero and provide measures that drive green growth for the sector and the nation.’

He added: ‘The strong start to the year is mirrored in the latest market outlook, which anticipates 1.79 million new car registrations in 2023 – an 11.1 per cent increase on the past year but still well below 2019 levels.

‘This also represents a 0.8 per cent reduction on October’s outlook, against a weak economic backdrop.

‘However, a further 9.3 per cent increase is expected next year, with 1.96 million new cars expected to join the road in 2024.’

What the industry says

Crisis has to be contained

UK’s 2023 new car sales performance will heavily depend on how well the cost-of-living and energy crisis is handled.

Electric vehicles were the success story last year. For uptake to continue growing this year, it’s crucial the cost-of-living crisis is contained as the technology continues to command a premium over petrol and diesel models.

Jim Holder, editorial director, What Car?

A reassuring sign

Six consecutive months of year-on-year sales growth is a reassuring sign for the industry and highlights that despite the current political and economic turbulence, the new car market is running counter-cyclical to the wider economy.

However, the dip in electric car sales reveals that December’s record performance – when one in three new cars sold in the UK was electric – was artificially inflated due to Tesla’s huge quarterly vehicle delivery and the impact of annual manufacturer emissions targets, rather than reflecting genuine consumer appetite at that level.

Ian Plummer, commercial director, Auto Trader

Still pursuing greener pastures

The freezing temperatures at the start of the year may have kept people indoors but it didn’t put them off buying a new car.

Last year’s slow new car sales have certainly speeded up this winter.

While demand for used EVs has slowed, the January figures speak for themselves with new electric sales rising 19.8 per cent, proving that motorists are still pursuing greener pastures.

Alex Buttle, co-founder, Motorway

Key question

Welcome though it is, the surge in sales is partly a case of the market playing catch-up, as manufacturers work through the backlog of orders that were placed, but not fulfilled, last year as supply chain disruption held back the supply of new cars.

Looking ahead, the key question for buyer demand will be the extent to which the rising cost of living impacts on people’s willingness to commit to big-ticket purchases such as a brand-new car.

Mark Oakley, director, AA Cars

Ray of hope

January’s new car registrations data provide an uplifting start to the new year.

The market is showing signs of accelerating growth in 2023, as manufacturers work to restore production to pre-pandemic levels.

Crucially, EVs and AFVs provide a ray of hope – one in 10 Brits are set to buy an electric car next, and more than one in five will move to hybrid.

Lisa Watson, director of sales, Close Brothers Motor Finance

Bring back grant for cheaper end of EV market

We expect to see more than a million BEVs on the roads by the end of this year, led by continued fleet take-up.

But more needs to be done to address the high up-front costs that prevents many private consumers who want to make the switch from doing so.

We’d like to see the return of a plug-in car grant aimed at the cheaper end of the EV market, to help stimulate demand and encourage car makers to produce more affordable models.

Simon Williams, spokesman, RAC

Car Dealer Live – the future of the car dealer – exclusive conference features talks from leading car dealers, Google and Auto Trader among much more. Find out the full event details and book tickets.