2021 will go down as the year of online sales, stock shortages and the moment when electric cars took on a whole new importance.

Those were just a few of the themes picked out by Auto Trader chief operating officer Catherine Faiers when she appeared on Car Dealer Live this week.

In the full interview, which you can watch at the top of this story, Faiers and host James Batchelor chatted about the last 12 months and the year ahead for car dealers.

And the overall message is that while there will be challenges in 2022, the dealers who use data and continue to embrace online car retailing will thrive in a market that’s in remarkably good shape.

Strong end to 2021

Despite the government announcing Plan B and rumours of even further restrictions, the used car market is ending the year in strong health, said Catherine Faiers.

‘We’re seeing levels of consumer demand continuing to increase on our platform,’ she said. ‘And equally, we’re seeing the value consumers place on car ownership and having access to a car, again, is at record levels, because of all the all the concerns out there around the latest variant.’

Faiers explained that on week commencing December 4, Auto Trader numbers were up by around 20 per cent on 2019, while for week commencing December 20, numbers were up by 23 per cent.

As for pricing, the market is remaining strong overall with a slight softening in December attributable to typical seasonal trends. ‘We are still seeing pricing growth up by a record 28 per cent year-on-year,’ she said. ‘It doesn’t show any signs of slowing down – strong demand coupled with continued supply constraints means that overall pricing is very robust indeed.’

2021’s key takeaways

Solid trading despite lockdowns

‘Dealers have traded surprisingly well during the lockdowns,’ said Faiers. ‘If you had asked us in 2019 what kind of sales volumes would retailers be able to support and deliver if forecourts weren’t widely open for retailing, I don’t think anyone would have said they’d be 84 per cent of typical volumes in the third lockdown.

‘So, I think for the next few weeks and months, wherever they take us, retailers should feel confident, be getting on the front foot and taking the opportunities they’ll be in the market.’

Shift to online

Dealers adapted to the world of handling enquiries and selling cars online very quickly in 2021 – they had to, after all. However, the changes the market has seen are concrete, and the days pre-pandemic are long gone said Faiers.

‘Overall online sales in the UK for all categories jumped from about 18 per cent prior to the pandemic to about 26 per cent in Q3 of this year – and in Q3 this year, you’ll remember, we were about six months out the other side of the last lockdown,’ she said.

‘We’ve definitely seen that play through into automotive with many of those traditional barriers, whether it was the test drive or completing the finance application on the forecourt, being broken down. All of those factors are giving consumers confidence to do more of the buying journey online.’

When electric went big

‘I think we will look back on 2021 as the year of the electric vehicle,’ remarked Faiers.

‘In many ways, I think consumer interest and willingness is now established. We’ve gone from that very early adopter phase to electric cars now being a viable alternative for many consumers.

‘And when we look at the pace of consumer demand growth on Auto Trader for electric vehicles, it’s huge. We’re now seeing one in five new car consumers looking at electric cars – that’s three times the level we were seeing just last year, and we’ve now got four times the number of models on site.

‘When you look at the number of new electric vehicles arriving in 2022, it’s a case of when, not if, those barriers around adoption and affordability are broken down.’

Top tips for 2022

Use data tools…

‘Using data to source and price is more important than ever, especially given the pace of the market,’ said Faiers. ‘When it comes to stocking and sourcing policies, the impact of those 1.4m lost transactions this year does mean that competition for vehicles sub-five years old is going to be more intense than it’s ever been.’

…and digital ones too

Faiers said: ‘Enabling digital retailing features is now a must-do for all retailers. It’s not just about having the best possible online journey, but also about thinking digital-first and then making the most of your physical forecourt presence.’

Space for electric specialists

Faiers explained that with the electric car market being defined by a new car rather than a used one, franchised dealers have an advantage when it comes to understanding the EV customer’s needs and wishes. But there’s a great opportunity for specialists, too.

‘We are seeing some brilliant used car specialist retailers emerge in the electric vehicle space. There is definitely an opportunity for new specialist retailers to emerge.

‘I think that will be one of the most exciting trends we’ll see in 2022.’

Will sourcing stock get easier in 2022?

The short answer is no, and unsurprisingly it’s the fault of new car supply.

‘2022 will be the third year in a row where we’ve seen relatively low levels of new car transactions by historic standards, and that is going to have an impact on vehicle availability,’ explained Faiers.

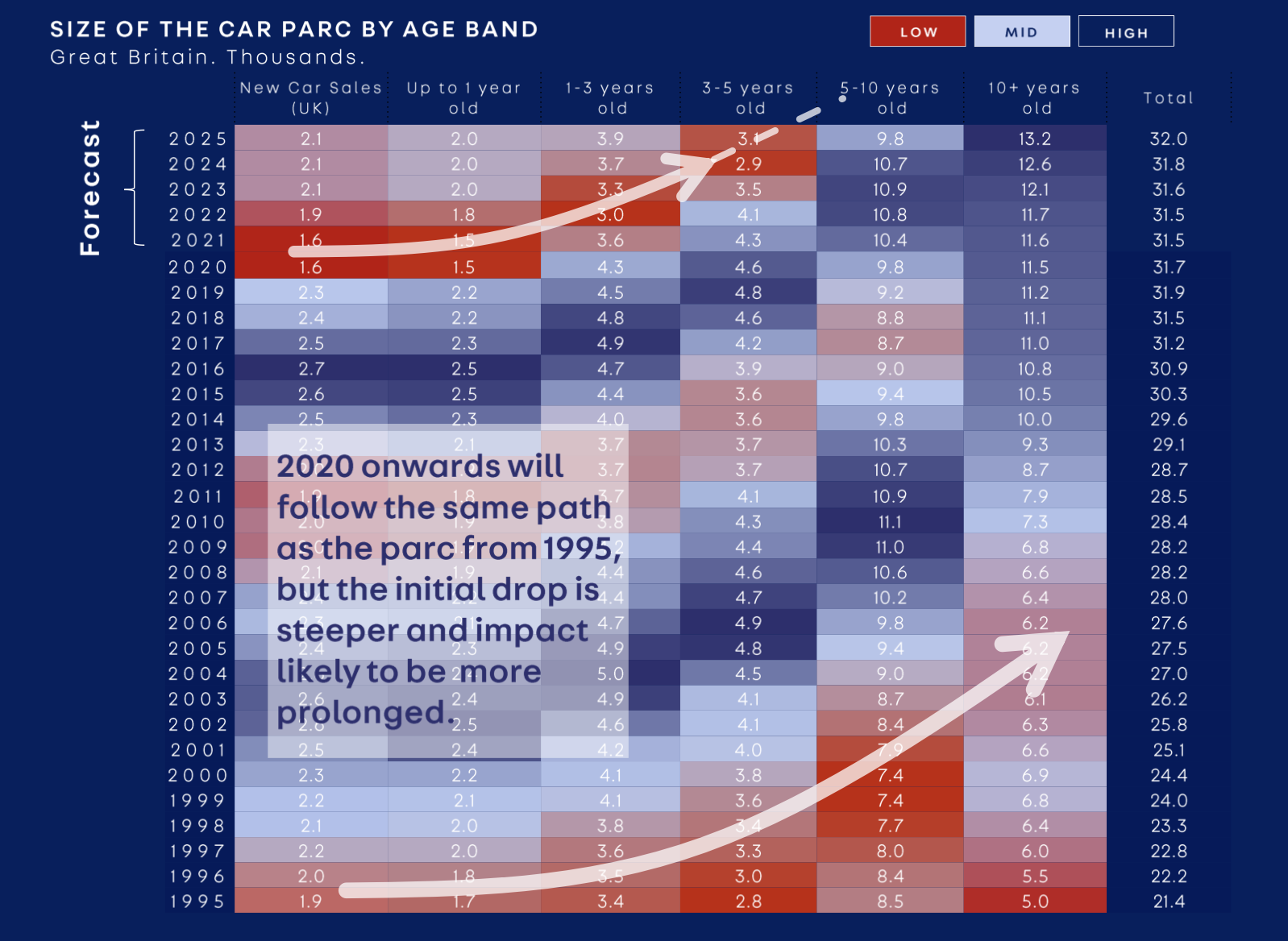

‘The headline is that by by 2024, there’ll be a third fewer three-to-five year-old vehicles than we would have seen in 2019. So, there’ll be about 2.9m vehicles in that age cohort, compared to the 4.8m or so vehicles we had in that age cohort in 2019.

‘Our insight team have mapped this out back to 1995 (pictured above) – they’ve looked at the size of new car registrations in any given year, and then how they flow through to the used car market in subsequent years.

‘We actually know today what the used car market is going to be experiencing for the next 10 years, and the impact of that 1.4m lost new car transactions that we’ve seen during that pandemic is going to impact the used car market for many years to come.’

Also discussed:

- New and used car transaction predictions in 2022

- Top tips for dealers to trade in the first few weeks of the new year

- The effect of the wider macro economy on the motor trade

Click the video at the top of this story to watch the full interview