Online used car dealer Cazoo’s job cuts and business closures helped it improve its performance in the first quarter of 2023.

In an update by the new chief executive officer Paul Whitehead – who has taken over from founder Alex Chesterman – the used car dealer said it made £980 per car it sold in the first three months of the year.

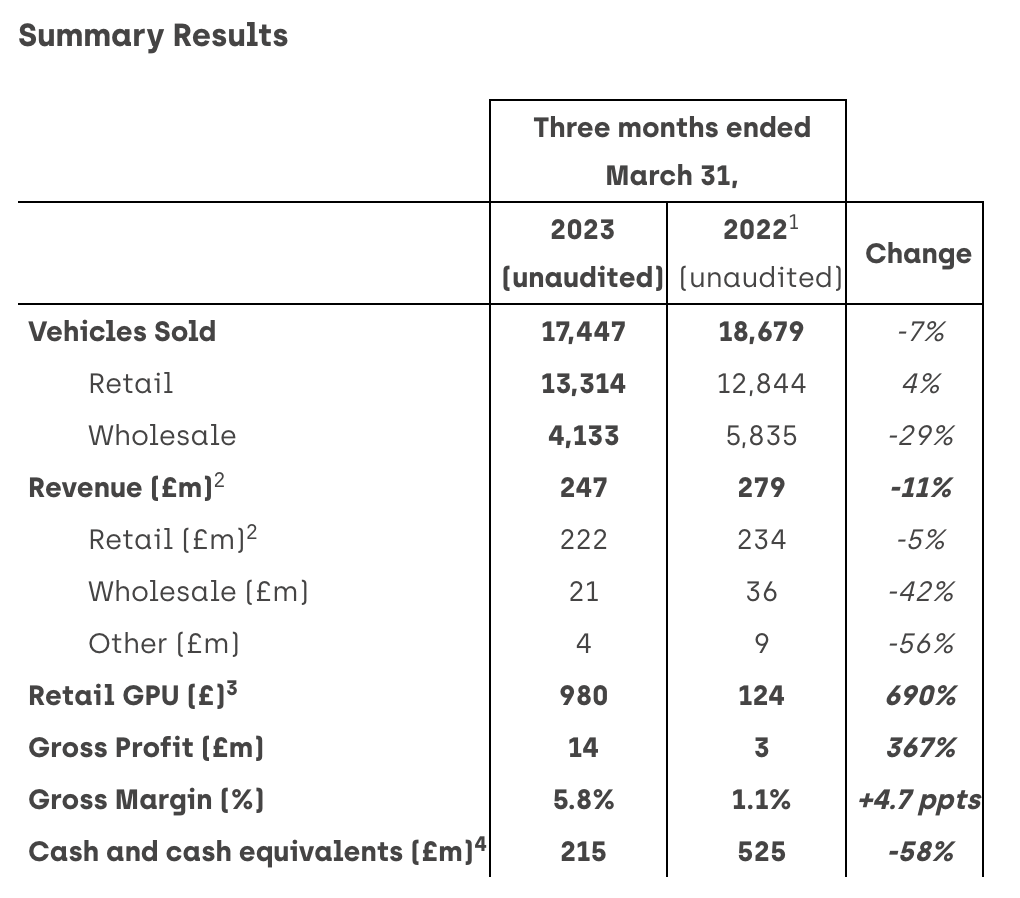

The total number of used cars sold fell, though, by seven per cent compared to the same period last year with the firm flogging 17,447 used cars (2022 Q1: 18,679).

Revenue also dropped 11 per cent to £247m with £222m generated from retail sales of used cars, £21m from trade sales and £4m from other operations.

Cazoo told investors in this morning’s 11.30am briefing that it made £14m gross profit in the quarter.

The used car dealer said it was targeting £1,200 profit per car for the year and said it actually managed to achieve that in March.

‘We remain laser-focused on improving our unit economics, optimising our fixed cost base and maximising our cash runway,’ said Whitehead.

This time last year, Cazoo was making just £124 per car, so the improvement to £980 represents a 690 per cent rise.

Gross profit per unit for the whole of last year for Cazoo actually FELL from just £427 per car in 2021 to a woeful £403 in 2022. In March, the firm announced a £704m loss for 2022.

Whitehead said he was ‘pleased’ with the used car dealer’s performance in the first quarter of 2023.

He said: ‘Our focus on unit economics, together with the restructuring changes, is starting to bear fruit as evident in the significant improvement in retail GPU to £980 in Q1 2023.

‘While the broader economic environment remains challenging, demand was robust in the quarter and we sold 13,314 retail cars as our online proposition continues to resonate with consumers due to the selection, transparency and convenience of using our platform.’

Despite the improving figures, Cazoo still expects to book a £100m-120m EBITDA loss for the year.

Earlier this year Cazoo decided to shut 15 of its customer centres across the country and make hundreds of staff redundant. The company only retained sites in Birmingham, Bristol, Chertsey, Lakeside, Manchester, Northampton and Wembley.

Cazoo also sold its operations in Germany, Italy and Spain, shut down its car subscription business and is in the process of selling off a large proportion of its prep centres. In February, it also sold its data business Cazana.

The decision to reduce head count resulted in one-off charges of £13m in the first quarter, said Whitehead.

The closures are expected to save the business some £25m per quarter in 2023.

The used car dealer also reiterated its plans for the full year which included a goal of selling between 50,000 and 60,000 cars – 40,000-50,000 of which will be to retail customers.

It is also aiming to finish the year with cash (and cash equivalents) of £110m-£130m. At present it has £215m banked.

Whitehead added: ‘We are applying a more targeted approach to which vehicles we buy, guided by our proprietary data of their desirability, with a better selection of models available on our website driving better margins.

‘During the quarter, a record 52.5 per cent of buyers (up from 47.4 per cent in Q1 2022) arranged financing directly through our platform entirely online, as we saw more applications together with better customer quality and higher acceptance rates.

‘Reconditioning costs have continued to improve following the consolidation of our vehicle preparation centres and the relentless drive for greater efficiency from the team. We expect to see further progress across both these areas as well as across logistics spend and marketing effectiveness.’