Chinese car makers could dominate as much as 20% of the UK car market in just four years’ time as their aggressive growth in the UK accelerates.

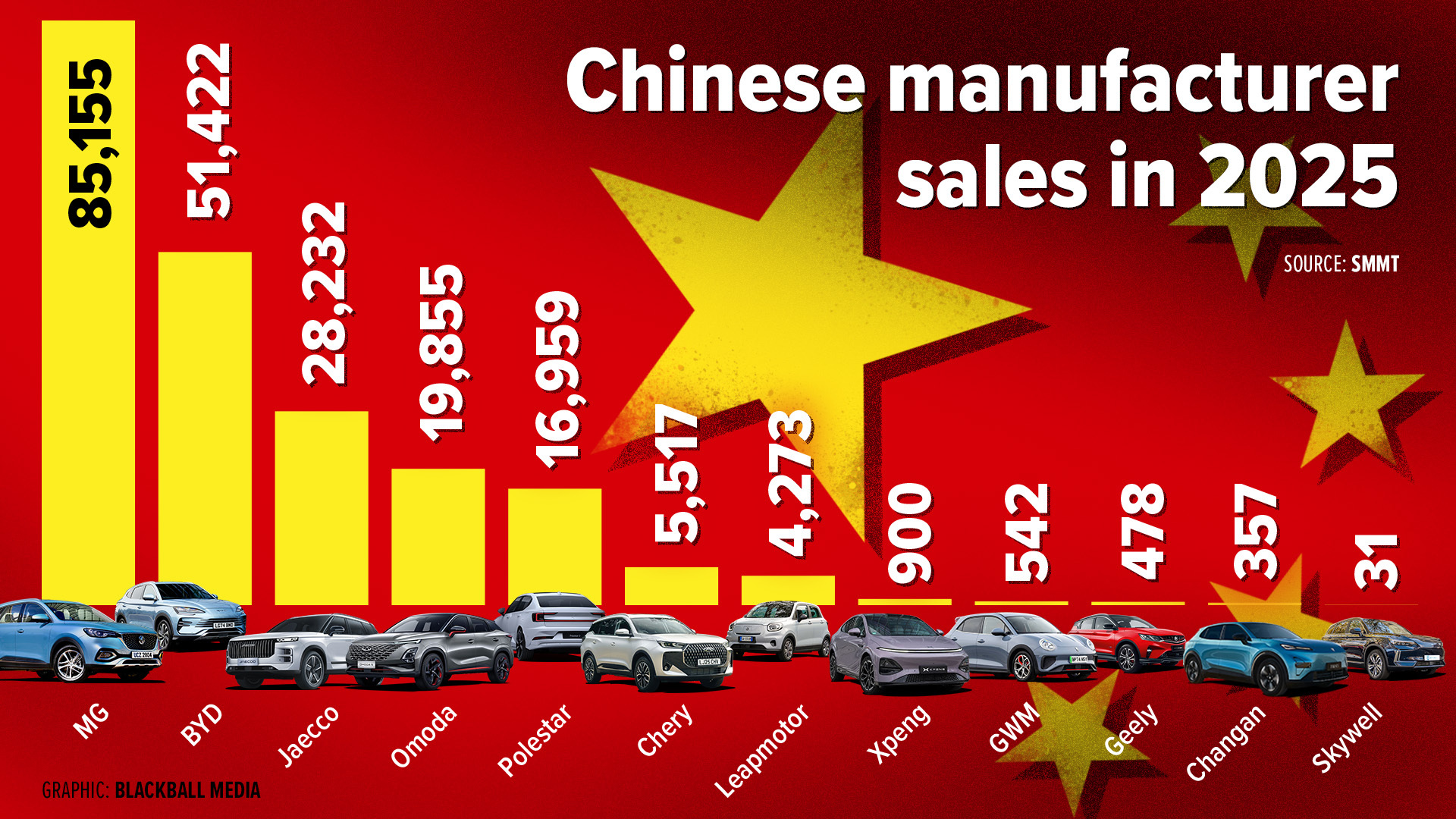

In 2025, Chinese brands managed to corner 10% of the UK car market, selling more than 111,000 units – some from a standing start.

The new entrants – including BYD, Omoda and Jaecoo – saw sales sky rocket as consumers hunted out low-priced motoring and swapped out of their heritage brands.

But just how have the Chinese managed to grow so quickly? And just how big will they get?

Car Dealer has produced a video about the rampant rise of the Chinese car makers, which you can watch above. It delves into the challengers’ huge growth in the UK.

‘In my view it is highly likely that the Chinese brands collectively will have a higher share than the Japanese or the Koreans, perhaps reaching 20% by 2030 – double where they stand now,’ said Steve Young, of automotive research firm ICDP.

Young points out that the overall car market won’t grow to accommodate these Chinese sales – instead they’ll be securing customers from legacy brands. Some dealers we spoke to predicted a ‘bloodbath’ of brands.

‘These new brands are ripping up the rule book,’ said one dealer group boss who has invested heavily in the Chinese.

‘They don’t care what the showrooms look like at the start, their rules are far more relaxed and they want to work with you. The speed at which they work is staggering.’

That speed has helped the Chinese create vast dealer networks in a very short space of time and, with those showrooms, comes sales.

It took Hyundai more than 27 years to achieve a 2% market share in the UK, Kia nearly 18 years and MG some 12 years – BYD managed it in two, Omoda and Jaecoo, in just nine months.

SMMT figures revealed BYD sold 51,000 cars last year, achieving a 2.5% market share, Omoda and Jaecoo combined notched up 48,000 sales – a 2.4% share. It’s worth remembering, Jaecoo only launched in January last year.

The Chinese are not just stealing the traditional car brands’ lunch – they’re feasting on it.

Chinese players are consistently outselling well-known car brands like Honda, Seat, Mini, Suzuki and Fiat, and many others. And most haven’t even got started yet.

Peter Smyth, director of car dealer group Swansway, has added BYD, Omoda and Jaecoo to his portfolio, and he is glad he did.

He said: ‘We seem to be winning customers from all sorts of brands, from premium to what they used to call volume manufacturers.

‘I think the ones that should worry are the Japanese. I think it’s a threat to the Japanese franchises that have a small market share.’

Autotrader predicts that by the end of this year, consumers could have some 80 car brands to choose from – up from 50 in 2019.

Marc Palmer, insights expert for Autotrader, said: ‘They doubled volume and doubled share in the space of 12 months. That kind of speed is almost unheard of in the UK car market.

‘And we’re seeing that continue. As we’ve seen more manufacturers enter, partner with more retailers and add more stock to the platform, there’s been a real boost.’

But how have the Chinese managed such huge growth so quickly? A lot comes down to price. These new models are packed with tech, look good and are available at a fraction of the price of established rivals.

Many are available with incredibly low deposits and low monthly payments. And they have arrived at a time cars from traditional manufacturers have soared in price.

The Chinese have been able to offer those on three-year finance deals a similar model to what they’re used to for the same monthly fee – something the traditional car brands can’t match.

‘When customers come in and see the cars, they’re surprised by the quality – and then they’re blown away by the technology,’ said Smyth.

‘In many cases, the Chinese product is two generations ahead of some of the legacy manufacturers.’

What the traditional car makers banked on was brand loyalty – but what they’ve rapidly learned is British consumers are far more interested in a bargain.

‘It’s like the Aldi and Lidl analogy – if you can get M&S-like quality at a fraction of the price, consumers will lap it up,’ said another dealer.

‘Those buying them love the fact they’re getting a bargain and importantly the cars don’t make them feel like they’re being shortchanged. Often the tech feels miles ahead of the Germans.’

Autotrader says one in four of all new car leads it sent to dealers last year was to a challenger brand. And the firm’s data shows consumers are cross-shopping the Chinese brands with the likes of Ford, Volkswagen and Hyundai.

Palmer added: ‘Early on, they were being compared largely with one another – but the new entrant brands have established themselves very quickly in competitor sets, not just against mid-range brands, but now against Volkswagen in reasonable strength.

‘We’re starting to see cross-shopping against really well-known brands and retailers are seeing part-exchanges coming in from established marques.’

Customers are passionate about their cars too. Delve into any one of the Chinese owners groups on Facebook and you’ll find plenty of positive comments. Jaecoo has even been affectionately nicknamed the ‘Temu Range Rover’ by its loyal buyers.

It certainly helps that these brands have been given a leg-up by the Chinese state. They have access to cheap capital and political support to expand overseas.

The UK is an incredibly profitable market for them too with cars selling for far in excess of what they retail for in their home market. While the Chinese offerings already look cheap, they have plenty in reserve to make them even cheaper.

And that could be important if any future governments ever impose tariffs. Currently the UK is an open market to the Chinese car brands, whereas in Europe they face 35% import taxes and in the States 100%.

‘When I was in China, I was in a showroom and a car that we sell at £35,000 here was up for sale there at less than $17,000, which is scary,’ added Smyth.

‘That tells you everything about the margin they have to play with.’

What no one knows is the long-term viability of these brands and their cars. While they might come with long warranties, their reliability here is untested, as is access to parts. And then there’s the wider question of their value in the used car market.

Will consumers want them in large numbers on the second-hand market, what sort of residual values will they command and what will a glut of cheaper used Chinese cars do to the overall values of all used cars?

While many try to work out the answers, China continues to build, launch and iterate and breakneck speed. It’s this ‘China speed’ that has taken the UK, and its sleeping legacy car manufacturers, by surprise.

Palmer added: ‘The quality of their first-time product and the way that product is refreshed and renewed, and the speed and agility that they’ve put that together is really quite striking.

‘They’re bringing cars into market very, very quickly – China Speed is in the UK for sure.’

Smyth added: ‘BYD want to be the number one best selling brand in the UK. There is no end to the Chinese ambition, and the way they target is so different from what we’re used to.’

While some might think Chinese cars are a fad, they’re here to stay. And while not all of them will be successful, some of the most successful will change the shape of British car buying for good.