The light commercial vehicle market dropped by six per cent to 16,165 units in February versus the same month last year, the SMMT said today (Mar 4).

February 2021 saw pent-up demand drive a 22 per cent increase in demand, the industry body pointed out, adding that the month was also historically volatile because of small volumes, since a lot of operators delayed buying until March’s new number plate.

But despite the worldwide shortage of semiconductors and increasing economic headwinds, including inflation, the market was still 14.6 per cent above the February 2020 pre-pandemic figure of 14,103, which the SMMT said reflected continued demand from key sectors.

The figure for large vans, which comprise two-thirds of the LCV market, was 10,638 units – 9.9 per cent down on last February – but medium-sized vehicles weighing more than two tonnes to 2.5 tonnes rose by 36.9 per cent to 4.024.

The battery-electric sector enjoyed soaring demand, with figures growing by 347.6 per cent in the month with 1,741 units registered.

That was mainly down to some significant fleet orders positively distorting a traditionally low-volume month, said the SMMT.

It added that overall uptake was still some way behind passenger cars, and it was vital for investment in EV charging infrastructure to give confidence to businesses and self-employed van operators to make the switch.

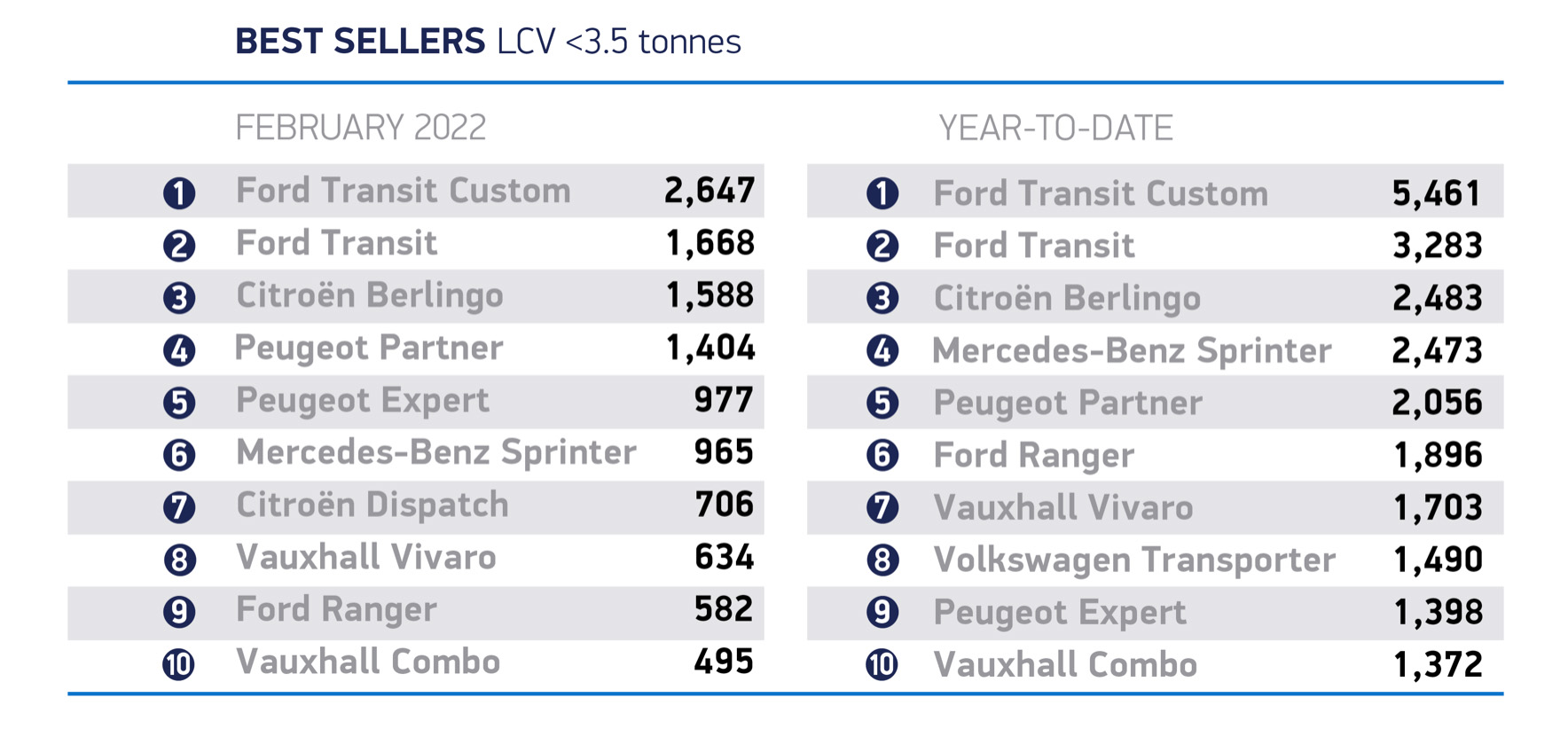

The three most popular LCVs were the Ford Transit Custom, pictured at top, Ford Transit and Citroen Berlingo, respectively.

Year-to-date registrations were down by 18.2 per cent, although the SMMT said that had to be measured against a strong start to 2021, when the construction and home delivery sectors drove significant demand.

It forecasts the LCV market will grow by two per cent overall this year, ending just shy of pre-pandemic levels and indicating a market stabilisation.

Chief executive Mike Hawes said: ‘LCV registrations have had a slightly slower start compared to last year’s bumper performance, reflecting the cyclical nature of fleet operator investment, but remain strong.

‘Global supply shortages and economic headwinds remain a challenge, however, and the sector’s switch to zero-emission vehicles must become mainstream.

‘More electrified models are coming on to the market this year, but we need the chargepoint roll-out to accelerate, giving more operators greater confidence to transition to the latest electric vans.’