Cazoo founder Alex Chesterman has laid out the detail of his cost cutting plan as he attempts to ‘right size’ the dealer for a slowdown in used car buying.

In an investor call yesterday, the Cazoo founder explained the drastic action the firm is taking to cut costs in an attempt to save £200m this year.

During the 40-minute presentation – which concluded with a question and answer session with investors – Chesterman and the CFO Stephen Morana said the firm will be cutting back on its expansion in Europe to focus on the UK.

The pair confirmed that Cazoo will be running down its ‘cash intensive’ subscription model which it has splashed out tens of millions of pounds building since it launched from the end of this month.

Cazoo acquired new car subscription businesses Drover in the UK and Germany’s similar business Cluno for undisclosed sums, believed to be in the tens of millions.

It says it will now be focussing on its used car retail operation which Chesterman believes is still a ‘materially better experience for car buyers’ than existing car sales.

In what has been described as a ‘profit warning’ by motor trade analysts, Chesterman cut forecasts for sales and profit per unit for 2022.

During the presentation, Chesterman said: ‘Great businesses are often built in the toughest times and we believe that while the opportunity ahead remains unchanged the barriers to entry are now even higher.

‘I have no doubt our businesses will be stronger and leaner as a result of the actions we are taking now and will continue to grow at a very fast pace while focussing much more on profitability and that ultimately we will win in a market that is likely to see less direct competitors in the future.’

Inside one of Cazoo’s customer handover sites

Chesterman believes the ‘size of the prize’ in the used car market in Europe ‘remains huge’ and said there was a £100bn annual market for used cars in the UK.

He said that the firm had expanded into France, Spain and Italy and that he believes there’s an additional £200bn used car market to take advantage of in Europe.

He said: ‘The addressable market is 26m used car transactions annually.

‘The size of the prize remains huge and we are addressing a massive market opportunity.

‘At the same time digital penetration in our market remains tiny, materially behind those seen in almost every other retail sector.

‘We strongly believe that irrespective of the economic climate over the next year or so, the used car market will remain huge and digital penetration will only continue to increase materially.

‘While the current market may be challenging we feel this economic shake up will serve to separate the winners from the rest of the pack.’

Subscriptions shut down

On closing the subscription services it worked hard on acquiring, Chesterman said this would release cash tied up in stock back into the business.

He said: ‘We will no longer be offering our car subscription service to new customers in any markets from the end of June.

‘The subscription model has some strategic benefits that we will continue to enjoy in the near term, but the model is highly cash intensive and we have decided to focus exclusively on our core retail proposition to both simplify our operation and logistics and to conserve cash.

‘We currently have over £90m of cash tied up in subscription inventory that will reduce to zero over time as existing subscription cars come back to us and become retail vehicles, increasing our cash balance significantly.’

Cazoo’s Southampton site will become its soul customer support centre

Site closures

Chesterman confirmed on the call that Cazoo will be shutting its customer centre in Leeds and reduce its support centres down to one single site in Southampton.

It will also close down two of its 10 vehicle preparation centres and, as revealed yesterday, slash 15 per cent of its workforce.

Chesterman said: ‘The plan involves us having to make some very tough but necessary decisions.

‘Sadly, approximately 15 per cent of our workforce, approximately 750 colleagues, across the company will be impacted by our rightsizing adjustments.

‘These actions will streamline our employee base across the UK and Europe.

‘In the UK we will see our employees per retail unit sold more than half between now and the end of 2023.

‘It’s a key focus that we will continue to have a market leading proposition and level of service.’

Marketing slashed

Chesterman said that there is now ‘80 per cent national awareness’ for his brand in the UK, but it will throttle back on its large sponsorship deals.

However, he added that ‘reducing overheads are a key part’ of the firm’s plan and this would involve focussing less on the large brand building advertising deals.

Cazoo will cut back on TV, radio and outdoor advertising too as it attempts to save money.

Answering a question from investors, Chesterman said he believed the sports sponsorship it had done had all been ‘very good deals’.

Cazoo has canned its Everton sponsorship deal

However, most were on three-year agreements with two-year break clauses which it can scale back from.

Cazoo has already cancelled its shirt sponsorship deal of Everton and will likely pull back from others to save cash.

Chesterman said Cazoo took advantage of Covid when brands were pulling back from marketing deals to snap them up for reduced rates.

He said: ‘Ignore what you read in the press about how much we paid. Generally we pay 50 per cent or less what previous sponsors were paying.’

Financials

What couldn’t be spun was the firm’s reduced sales forecasts.

Cazoo said that this year it will sell around 70,000-80,000 used cars to retail customers and generate revenues of around £1.4bn.

Previously, it said it would sell 100,000 cars and generate revenues of £2bn.

In the first quarter it made just £124 per used car sold and it hopes it increase this now to around £500-£600.

By the end of next year it wants to be making around £1,500 per used car sold – far closer to the performance of good, experienced car dealers.

£124

Profit per unit made by Cazoo in Q1 2022

To break even in 2023, finance chief Morana said, the firm needs to sell 12,000 cars a month with gross profit per unit of £1,500.

Cazoo sold 13.4k used cars in the first quarter of 2022 and has notched up 10.9k sales in April and May.

Gross profit per car sold has grown to £300 in those last two months, said Morana.

He also explained the firm would make the ‘vast majority’ of its revenues in the UK with ‘moderate EU numbers’ as Cazoo ‘pulls back some of our more ambitious EU growth targets to better preserve cash’.

Morana added: ‘Our European business will continue to be loss making for the near term but focus on cash preservation will mean the company spends wisely to position itself for the long term.’

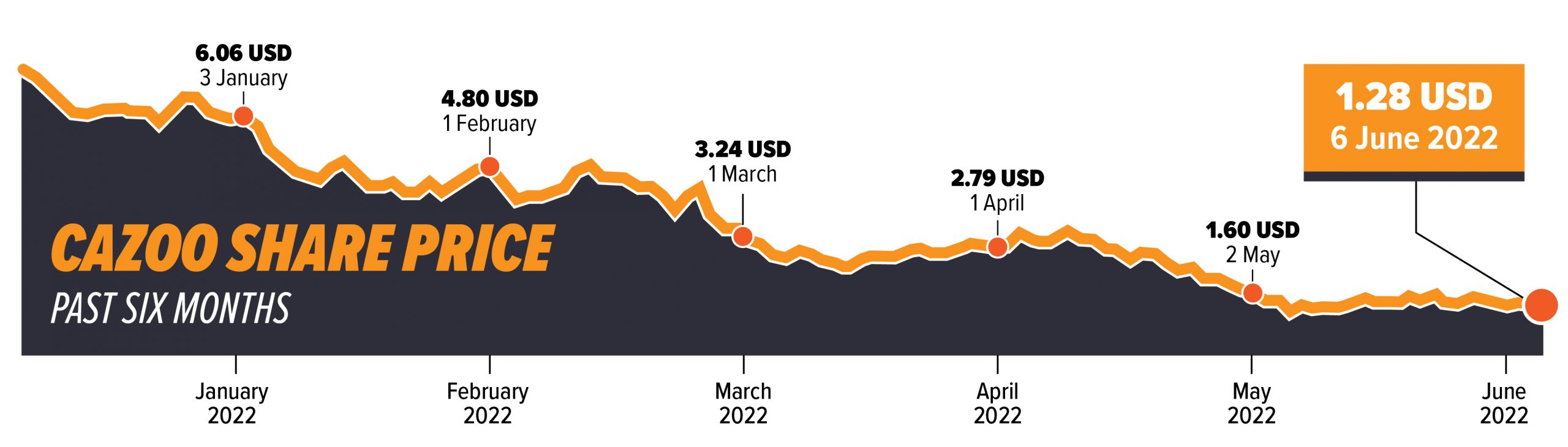

Cazoo’s share price has plummeted 86 per cent since it listed on the NYSE last year.

Downturn

Chesterman said Cazoo was ‘not immune’ from the economic downturn and laid the blame for its reduced forecasts on faltering demand.

He said: ‘The combination of rising inflation and interest rates with supply chain issues caused first by the pandemic and then exacerbated by the Ukraine conflict has driven up the cost of living and is hitting consumer confidence.

‘This perfect storm has made cash conservation top of mind for the company ahead of growth.

‘[Cazoo is] not immune to the rapid shift in deterioration of consumer confidence, volatility in the stock market and the possibility of recession in the coming months.

‘While we continue to grow over 80 per cent year-on-year, taking significant market share we cannot ignore the accelerated deterioration in the economic outlook and its potential impact on the consumer where we expect to see a further softening in consumer demand over the coming months.

‘Against this backdrop we are acting decisively to right size the business in the near term to ensure we are well positioned to ensure our long term targets.

‘We are prioritising sustainable growth and focussing on cash preservation above all else while still expecting to grow 100 per cent year-on-year in 2022.’

Asked by an analyst from JP Morgan about whether this slowdown had already been seen, Chesterman said he had and it was accelerating.

The Cazoo founder added: ‘It’s a combination of starting to see something that is accelerating in recent weeks with inflationary pressures and an impact on consumer confidence, a marginal shift in the types of cars people are looking for as cost of living starts to bite, so less expensive vehicles.

‘The guidance is really looking ahead and assuming that things don’t get any better and potentially get worse, which is why we are being cautious in our guidance.’

Rival online car dealer Carzam has entered voluntary receivership

Carzam

Chesterman also referred to the recent failure of Carzam – its online rival which was placed in voluntary receivership last week – as proof the financial markets are toughening.

He said: ‘[There has been a] deterioration in the finance environment as evidenced in our sector in the UK we saw a private business [Carzam] go out of business for an inability to raise funding.

‘The market leader in the States [Carvana] is struggling to raise financing and is having to raise debt at a very high rate. So the financing environment for businesses like ours are also deteriorating.

‘We are assuming that none of this gets better. Hence the reasons for the actions we have been taking.’

Chesterman said the cost cutting plan was designed to take the action needed now to help secure the firm’s growth in the future.

He added: ‘In times like these businesses like ours need to be laser focussed on what is most important – our number one priority is to reach cash flow break even in the UK and our realignment plan de-risks this significantly and we expect to deliver on this before the end of 2023.

‘We continue to see a huge opportunity in Europe, but we will temper our growth aspirations in the near term to increase our unit economics.

‘We accept that we cannot do everything, hence the decision to end the subscription business to focus our efforts entirely on our retail proposition.’

- Have online used car disruptors had their day?

- What is Cazoo?

- Comment: Why does Cazoo wind up the motor trade so much?

Struggling model

Analysts believe Carzam’s closure and Cazoo’s cost cutting plan is proof that online-only car dealerships are going to struggle.

UHY Hacker Young partner Ian McMahon said: ‘Following hot on the heels of Carzam’s administration last week, today’s job cuts show online-only car dealerships are really struggling.

‘It’s really disheartening to see jobs being put at risk or being cut after the huge transition the motor retail industry has been through in the last few years.

‘The online-only model is based on having lower costs than a bricks-and-mortar dealership would.

‘However a lot of them have spent so much on customer acquisition and advertising that their costs are, per unit, comparable to those of a traditional used car dealership.

‘There’s no sign that they are going to be able to acquire customers at a low enough cost in the near future.’

Alex Chesterman, above, laid bare Cazoo’s cuts in an investor call

Former TrustFord chairman Stuart Foulds, who retired last year, said he thought Cazoo was ‘an unmitigated disaster from day one’.

Writing on a Car Dealer post on LinkedIn, he said: ‘Their arrogance is unbelievable. To think they can enter an age old industry and take them on.

‘All savvy dealers have simply been nimble enough to align themselves but keep the best bits. The overwhelming fact is that customers want some physicality within the transaction borne out by umpteen dealers’ research.

‘Were I an investor (which thankfully I would never consider) I would be extremely unhappy at the tens of millions of money wasted on advertising and sponsorship which has borne no fruit.’

Zeus Capital analyst Mike Allen told Car Dealer yesterday that the announcement was fundamentally a ‘profit warning’.

He said: ‘Investor appetite is next to non-existent for these types of businesses now. The funding markets are incredibly tough, so they need to preserve what cash they have got for longer.

‘Clearly, the trading environment is not what it was last year and looks like it will get tougher.

‘Raising money is going to be harder for them, so they need to make moves like this to protect the money they have got.’